Protected Loops for RWAs

Unlock looping for illiquid assets with

Cork’s liquidity buffer

Ecosystem Partners

Looping illiquid assets is hard

Long-duration RWAs and vault tokens are challenging to loop due to a lack of secondary liquidity to unwind loops and perform liquidations.

Backed by

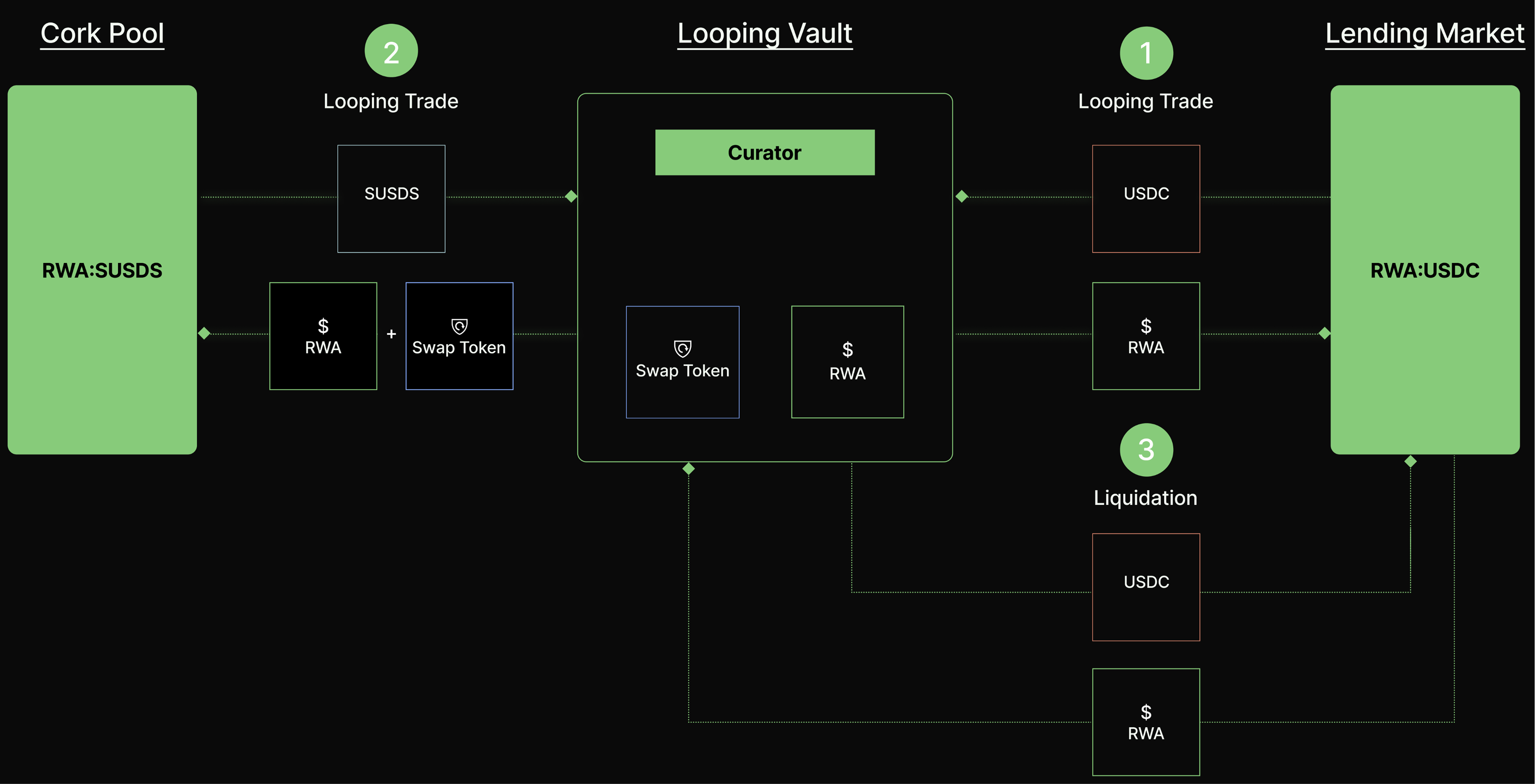

How it Works

A managed Looping Vault runs the strategy; a Cork Pool provides a standing exit via Swap Tokens into liquid collateral. The vault can unwind, re-collateralize, or act as liquidator atomically, keeping looping trades solvent and orderly.

Cork Secured By

The leading names in onchain security across the full product lifecycle, spanning system design, smart-contracts audits, formal verification, deployment, monitoring, and OpSec.

Learn about Cork’s security framework

coming soon

Key Benefits

Enabling looping of illiquid assets

Creates instant liquidity for the looped collateral

Simplified lending market liquidations

Subscribe

For onchain risk insights