.png)

Where is DeFi Today?

October 25

8 mins

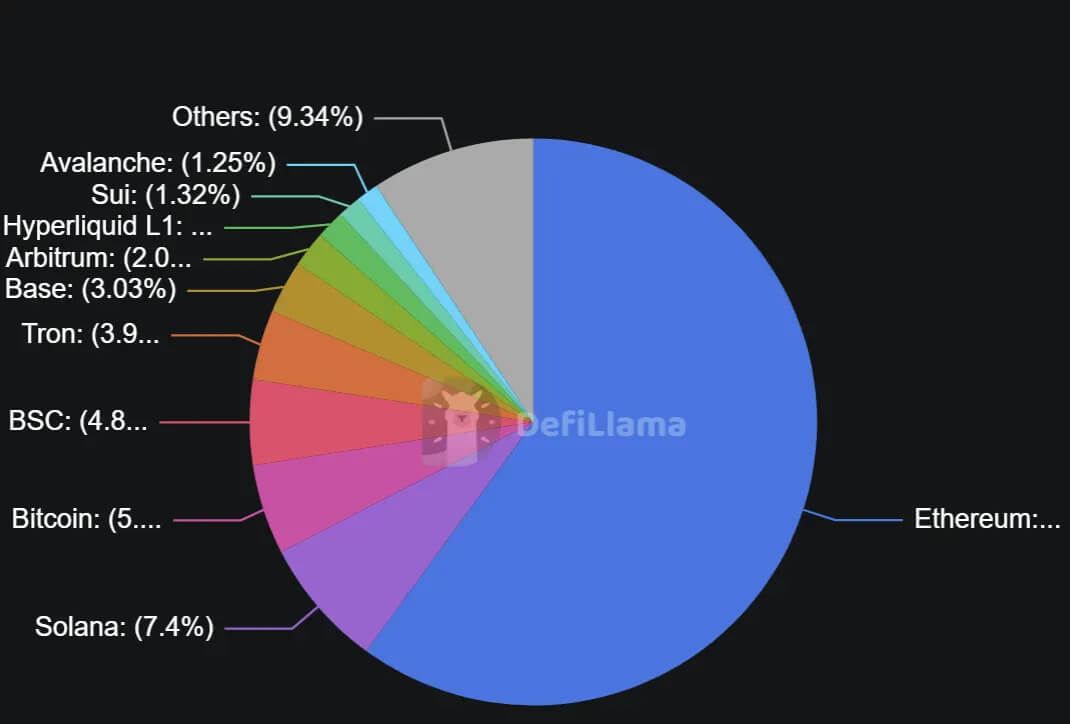

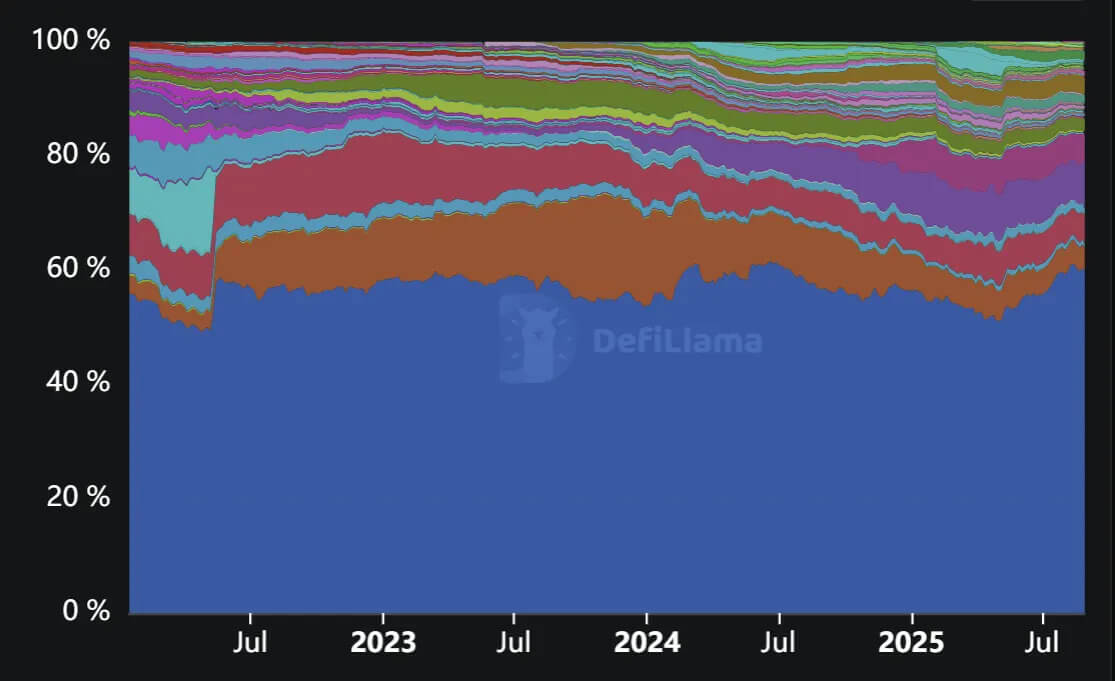

DeFi’s center of gravity remains Ethereum: L1 holds roughly 60% of TVL and Ethereum L1+L2 about 70%, a share that has barely shifted in three years—classic power-law network effects. The 2024–2025 meta is stablecoins, with market cap near $300B and payment volumes rivaling Visa, as policy clarity (e.g., the GENIUS Act) opens the door to broader adoption. At the same time, institutional flows—ETFs, digital asset treasuries, and tokenized RWAs—are reshaping market structure, while LSTs/LRTs supply the base yield powering carry trades across lending, perps, and DEXs. This piece maps the leaders in each category and explains how reflexivity ties prices, leverage, and TVL into what feels like a second DeFi summer.

Stablecoins

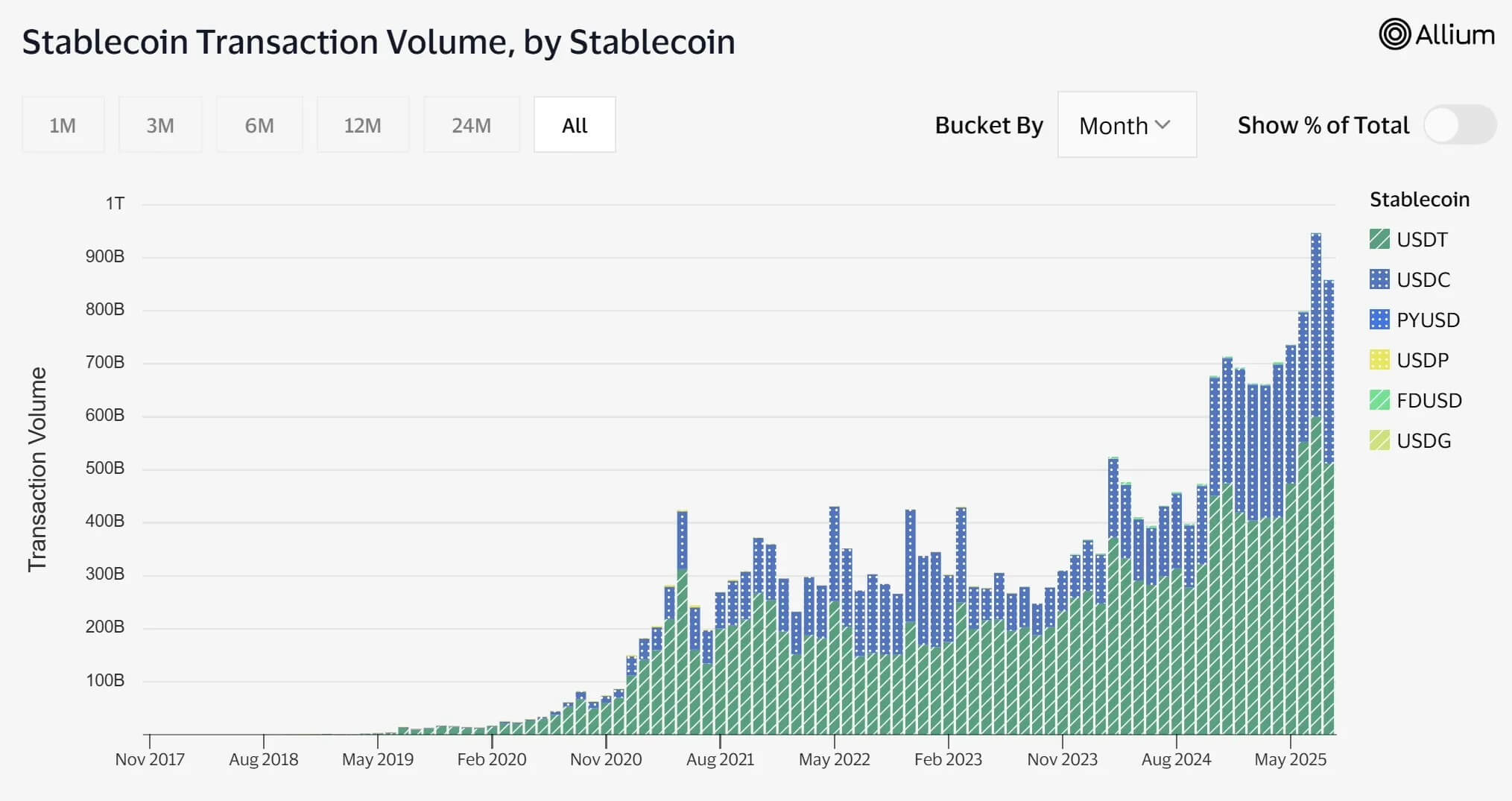

The meta of the 2024-2025 DeFi cycle has been stablecoins. Stablecoin TVL is rapidly approaching 300b$, driven by large scale increases in stablecoin volumes.

Stablecoin volumes are roughly on-par with the payment volumes in the Visa Network (1.1t$/mo), however, stablecoin volumes are growing rapidly.

The recent passing of GENIUS Act establishes clear regulatory frameworks for stablecoin adoption to become ubiquitous in the financial system, which will further accelerate stablecoin adoption. FintechStrategy reports that “Leading US banks, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are in preliminary discussions to launch a joint stablecoin.”

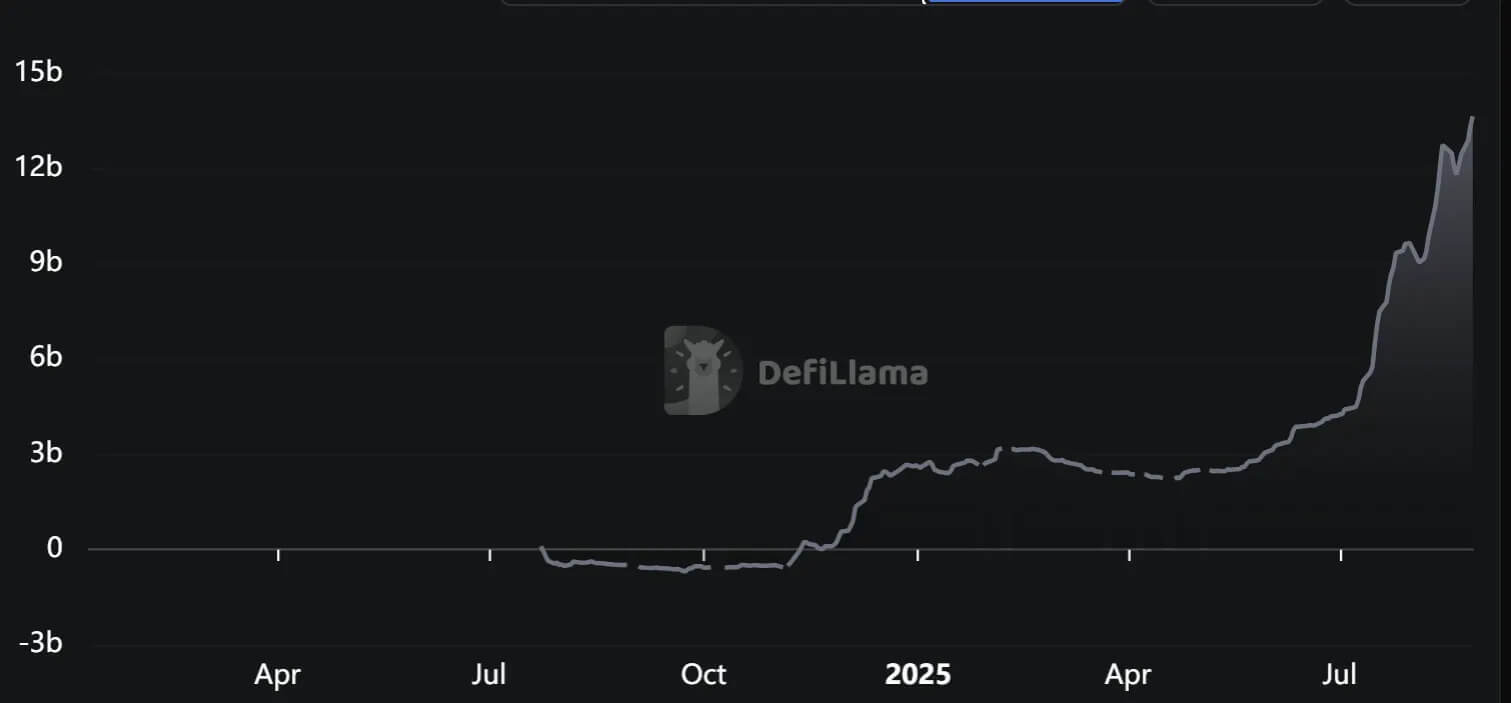

The most successful recent stablecoin launch is Ethena, becoming the fastest stablecoin to reach 10b$ TVL. Ethena has been a blowout success dominating the yield bearing stablecoin space. It is driving 1b$ of yield annualized, which is driving TVL growth across AMMs, lending markets, yield splitting protocols, vaults as well as improving the economics of perpetuals markets through lowered funding rates. Ethena is becoming a backbone of DeFi.

Institutional (Super)cycle

A major theme of the 2024-2025 cycle has been institutional adoption. In past cycles, institutions were “coming” - now they are really here and this adoption can be showcased through four separate data points.

- Regulated institutional products have gained massive TVL. The two most successful ETF launches in the last two years (out of 1600 ETFs) was Blackrock’s iShares BTC & ETH ETFs. Net flows into ETH ETFs are going vertical.

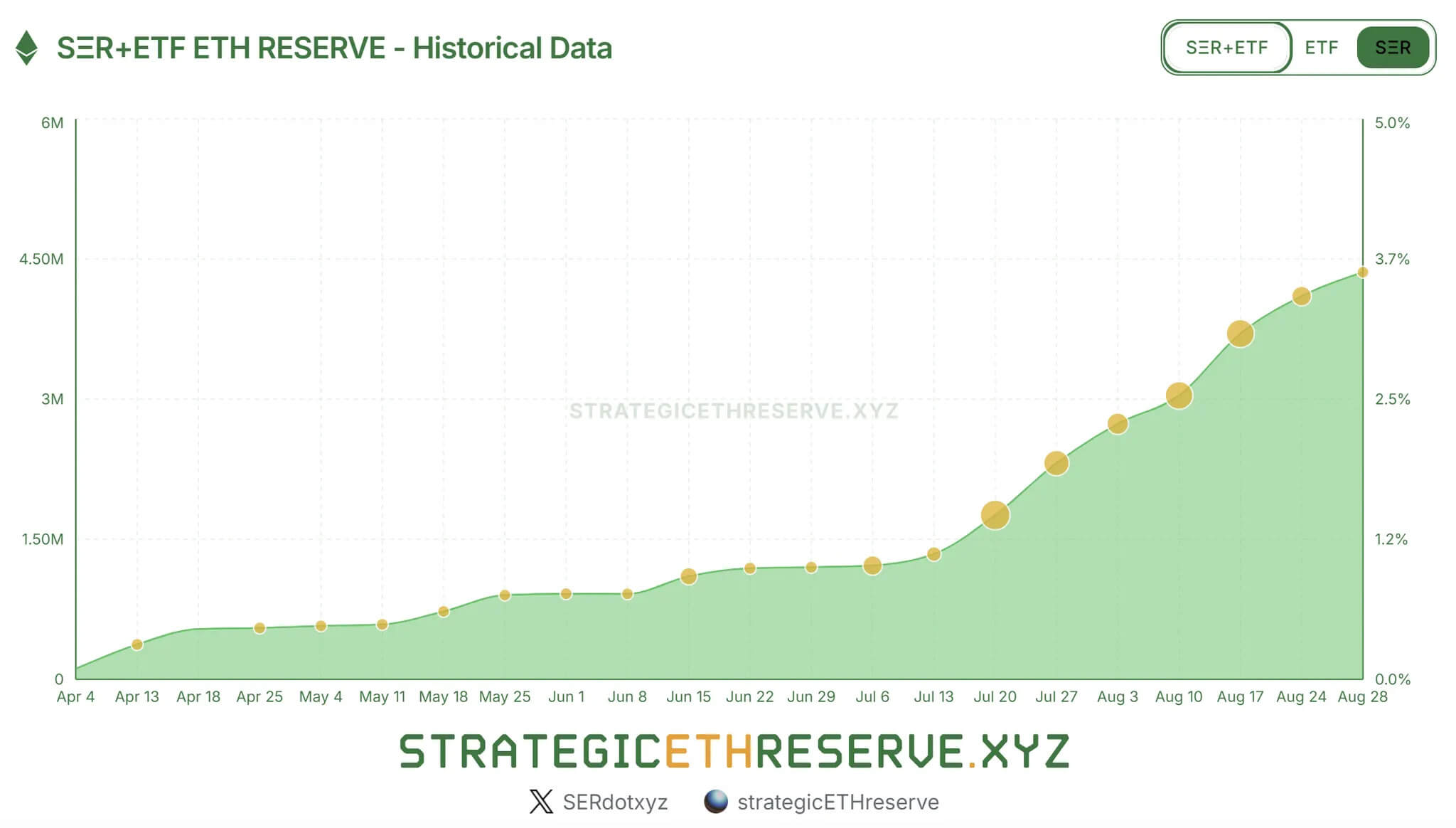

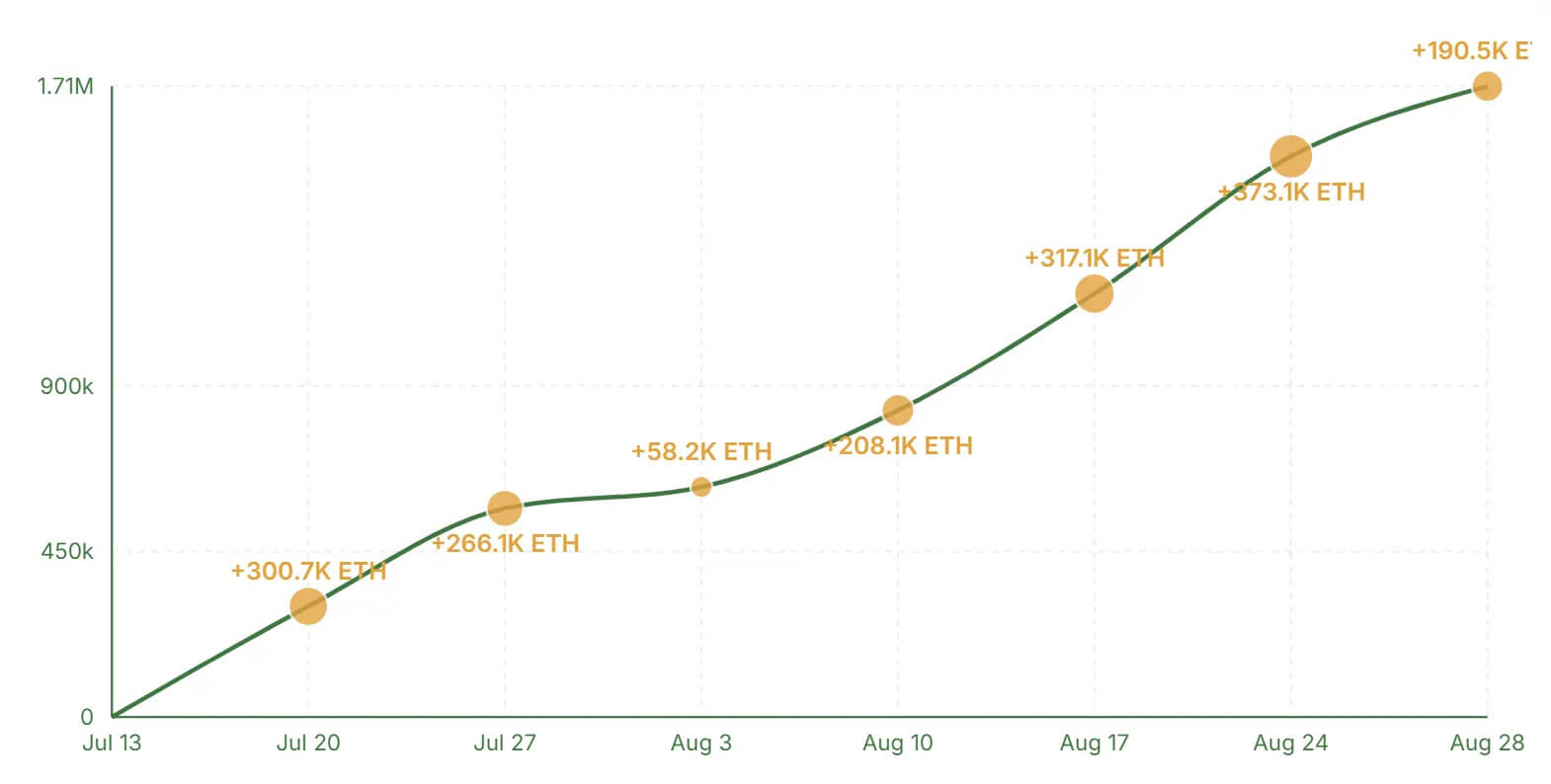

- Digital Asset Treasury companies attract capital from institutions, ETH DATs have in the past 2 months absorbed roughly 2.5% of ETH supply.

The largest DAT, Bitmine Immersion, with wall-street legend Tom Lee as chairperson, has accumulated about 9b$ of ETH in less than 2 months, driven by institutional demand for ETH exposure.

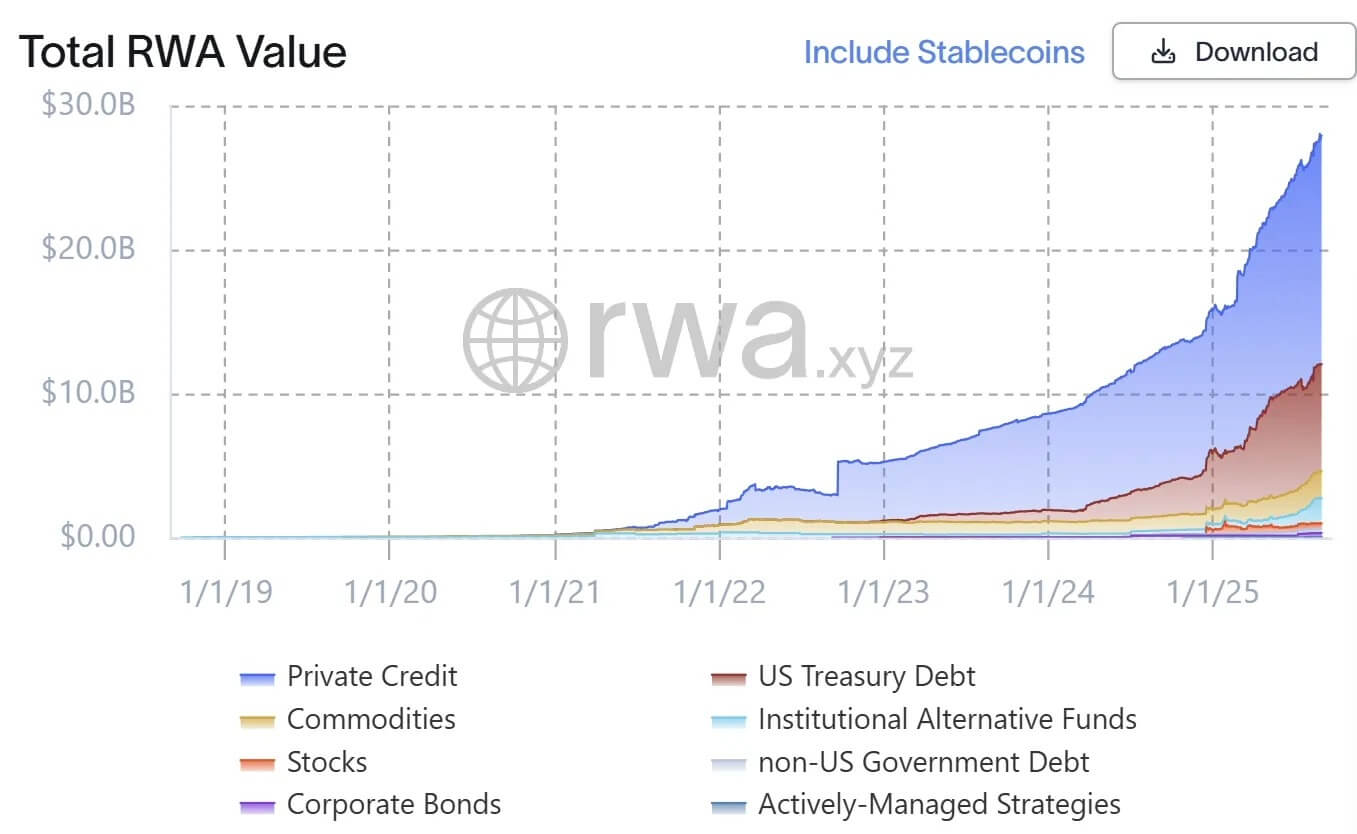

- The theme of tokenization has taken off, as seen in rapid growth of tokenized Real World Assets (RWAs). Major institutions are tokenizing products, including Robinhood Europe tokenizing their entire stock exchange, Blackrock tokenizing their t-bill Buidl product. Stablecoins and RWA tokenization growth, mostly happening on Ethereum, is driving the narrative that the future of the financial system is going to be on Ethereum. This is driving the institutional adoption of ETFs and DATs.

- Onchain activity has been dominated by institutional capital, as opposed to prior cycles. The 0.5% largest wallets (5600 total wallets) represent 92% of DeFi TVL. Whilst Solana memecoins and prediction markets may be more retail driven, DeFi is rapidly becoming an institutional ecosystem. Less green frogs, more spreadsheets.

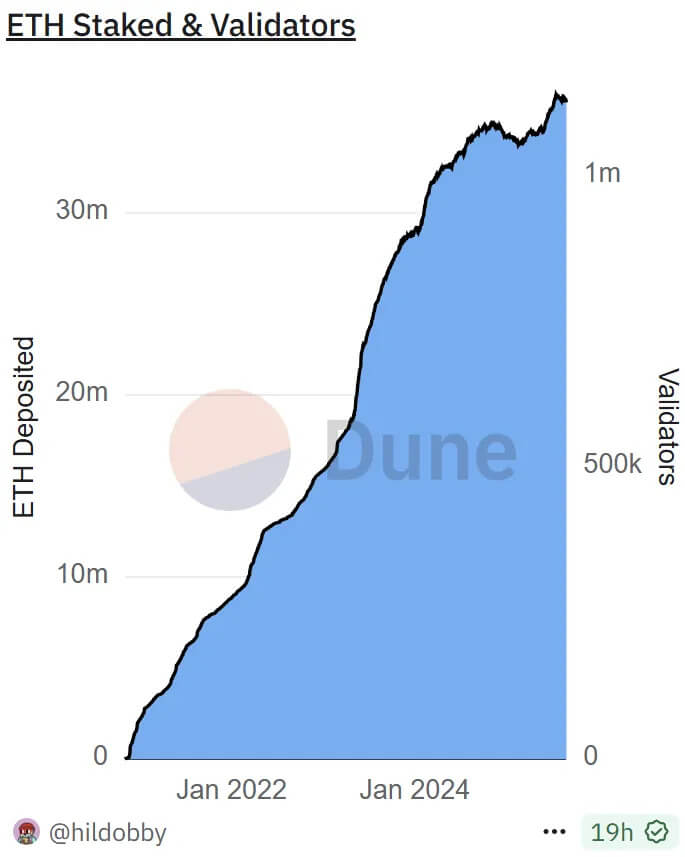

LSTs & LRTs

The largest source of yield in DeFi is coming from ETH staking and its derivatives. About 150b$ of TVL sits in staking, generating about 4.5b$ of incremental yield.

Liquid Staking Tokens (LST) are widely adopted in DeFi. The LST ecosystem is dominated by Lido, with an 86% market share and 40b$ of TVL.

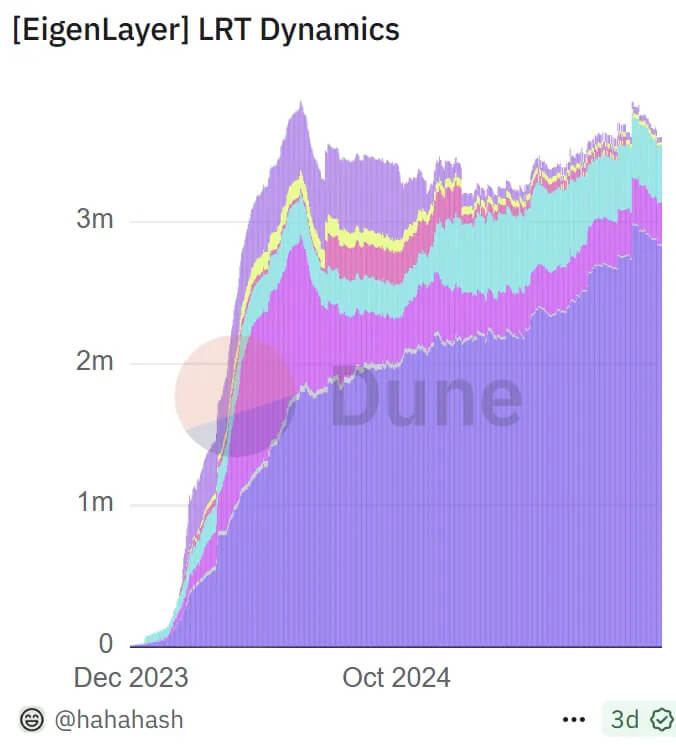

Restaking emerged as a major theme in late 2023 with the launch of Eigenlayer. Eigenlayer has retained about 8m of ETH in its system, remaining sticky over the last year, despite relatively low organic yield. Liquid Restaking Tokens have become a major collateral category in DeFi, with absolute dominance by EtherFi (dark purple) at 85% market share in the LRT category.

Lending Markets

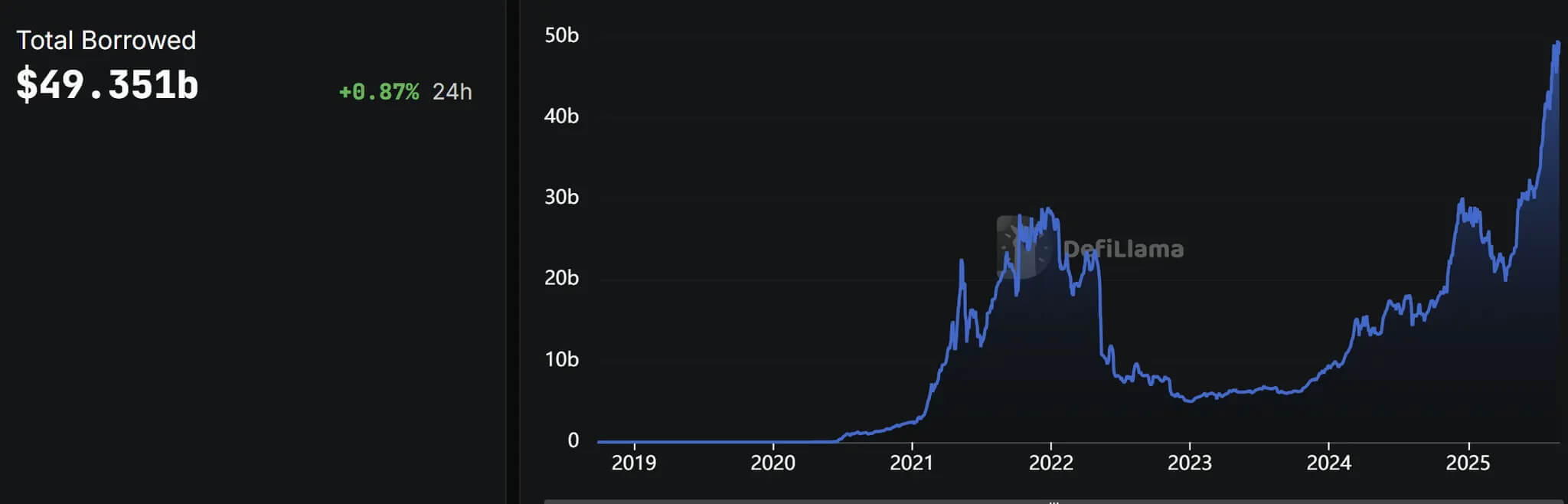

Bull markets are characterized by period of increasing use of leverage. Price appreciation and significant yield opportunities reward the early risk takers, which in turn drives lending market activity which produces further yield opportunities.

Aave remains the dominant lending market with 58% market share. Morpho is a distant second, with 7% market share. Permisionless lending market designs (Morpho/Euler) have gained significant traction, but are still far smaller than Aave.

The biggest use case in lending markets remains carry trades (looping), where the difference of native asset yield and borrow rates are arbitraged. Ethena USDe (6.5b$), Lido stETH (6.5b$) and EtherFi eETH (8.5b$) are a few of the biggest collateral types in Aave. Lending markets and carry trades are major driver of onchain yield for vaults and institutions.

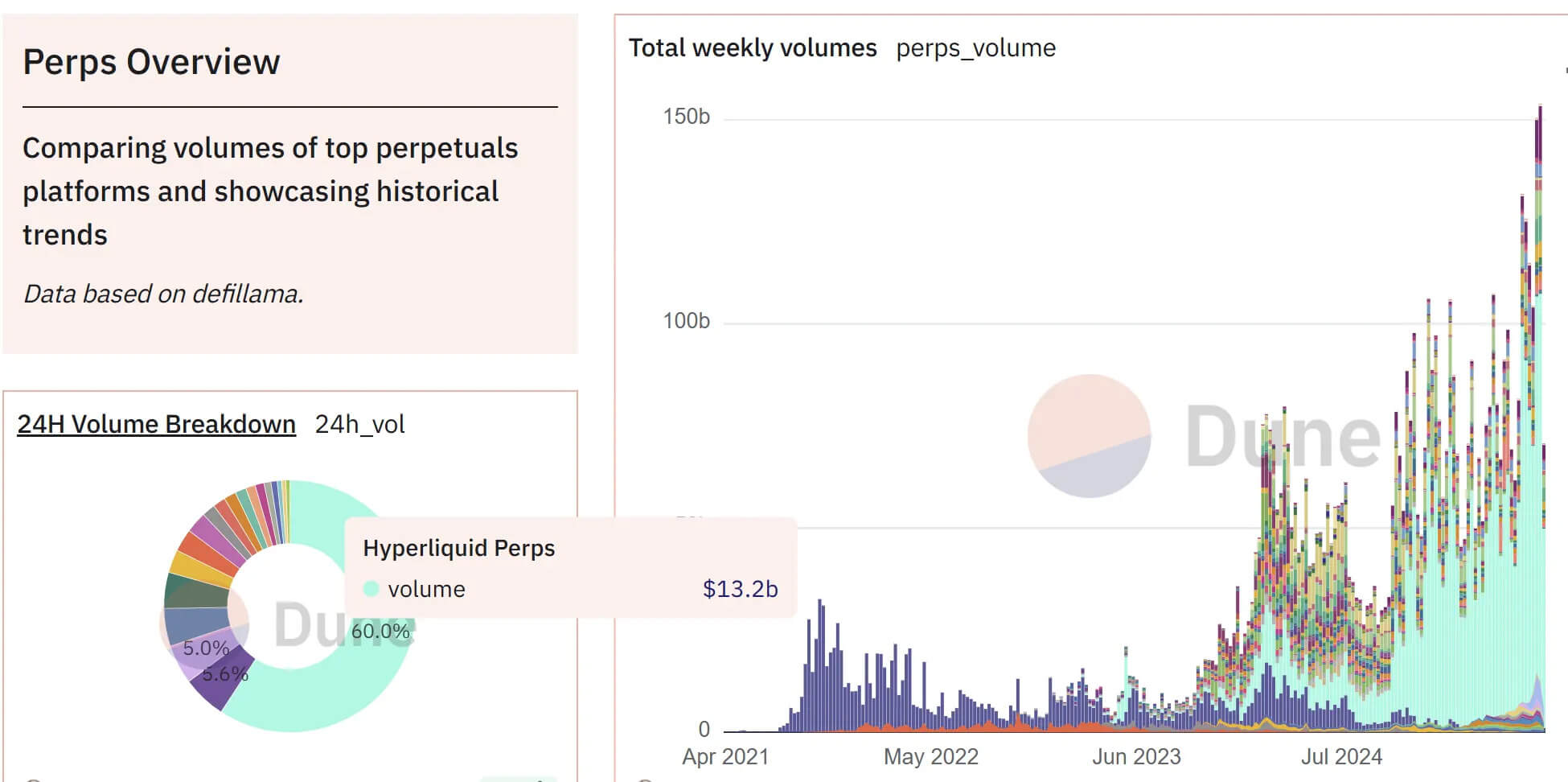

Perpetual Volumes

The Perpetual DEX market is exploding, dominated by Hyperliquid, which is starting to rival CEX counterparts in volume. For example 13b$ 24hr volume vs Binance: 24b$, Bybit: 4b$, Coinbase: 3.5b$. Perpetuals as a product has achieved product market fit and is proving to be a potentially better vehicle for leveraged trading than expiring options, and has the potential to proliferate beyond crypto native audiences - for example Robinhood launching stock perps.

The growth in the perp markets is becoming a driver of TVL growth in DeFi through yield in Ethena, as well as democratized market making vaults such as the Hyperliquid Liquidity Provider product with 600m$ of TVL earning 13% annualized.

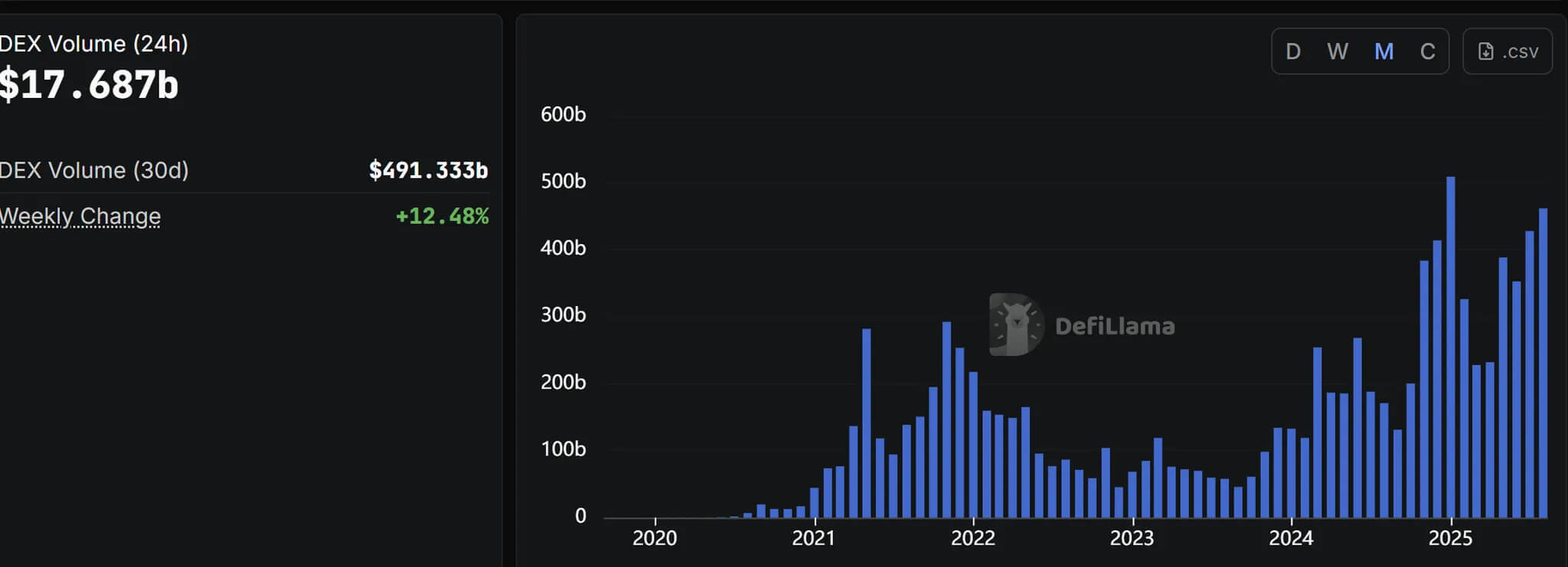

DEX Volumes

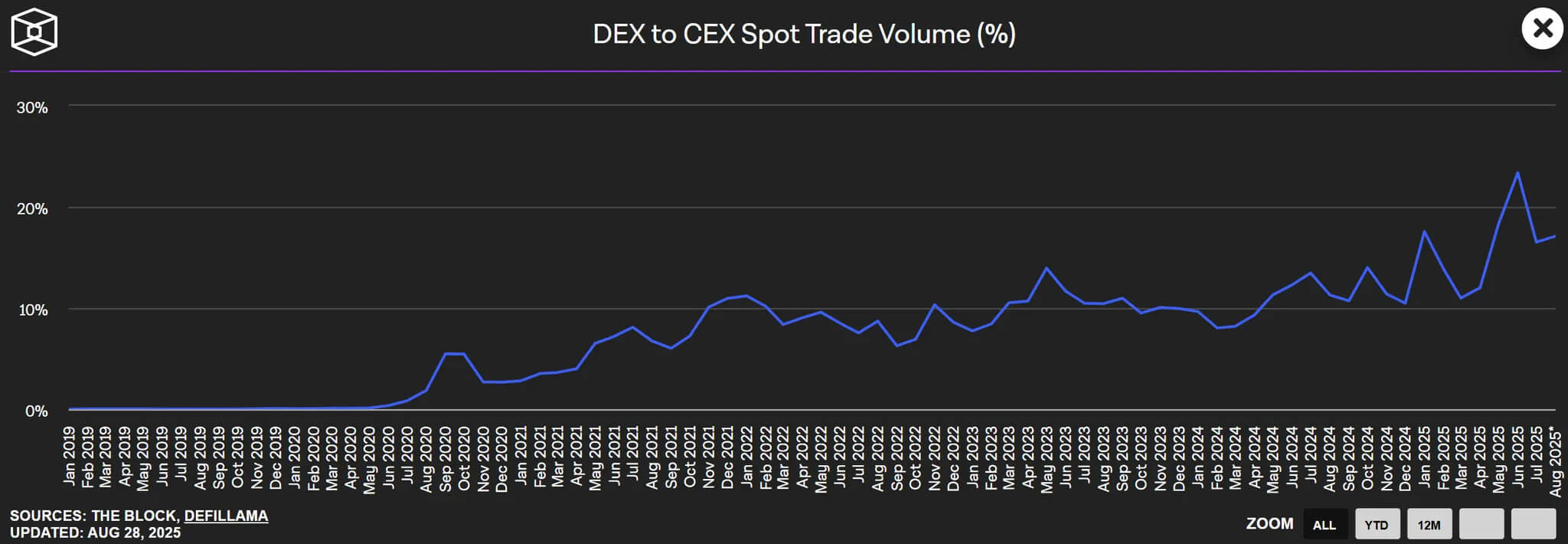

Decentralized Exchange (DEX) volumes are consistently at all-time-highs, reflecting two major trends:

- Onchain activity broadly is at an all-time-high (stablecoins, lending, perps etc.), which reflects in increased DEX trading volumes.

- DEXs are slowly absorbing market share from CEXs, with volumes growing to roughly 15-20% of CEX volumes. As DEX infrastructure and more activity flows onchain, at some point DEXs will flip CEX volumes.

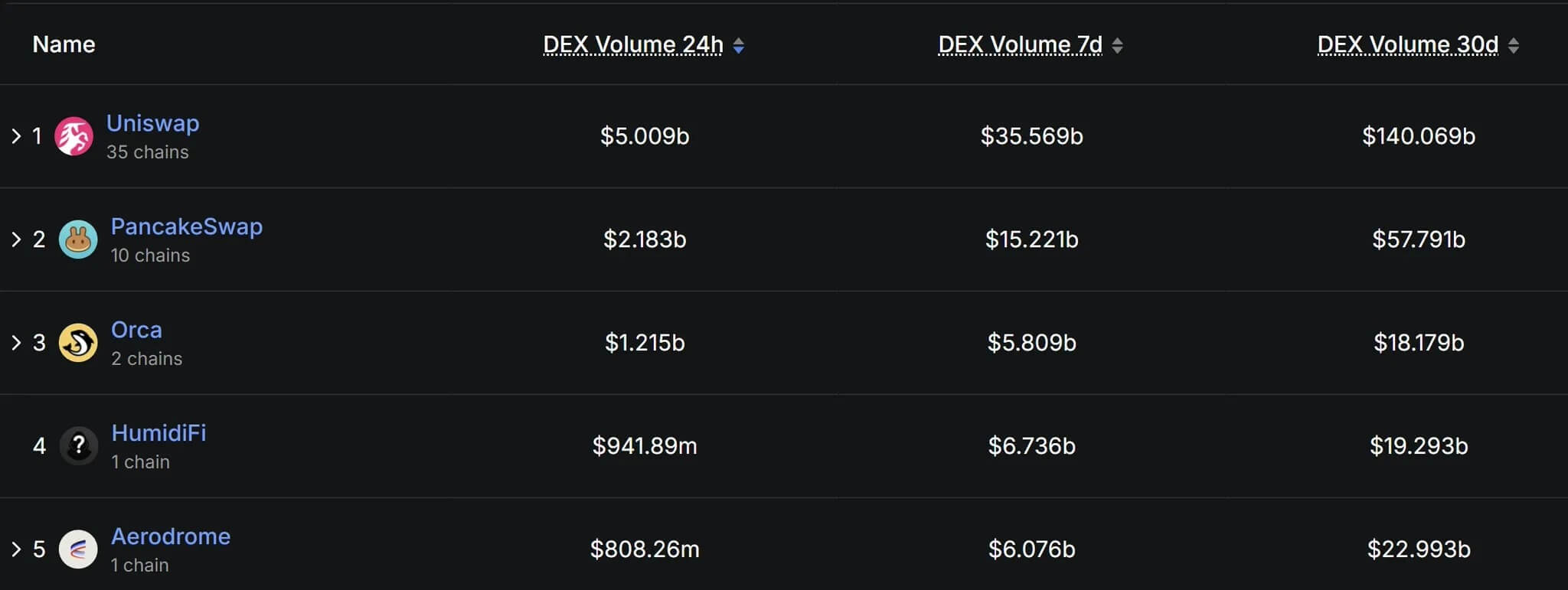

In terms of DEX competition, Uniswap is continuing to dominate volumes, serving as the powerlaw winner in the Ethereum ecosystem, whilst PancakeSwap domaintes BNB Chain, Orca on Solana and Aerodrome on Base. The strong liquidity network effects pools most capital towards one major protocol per ecosystem, because most of DeFi is on Ethereum, thus Uniswap in aggregate is the dominant DEX.

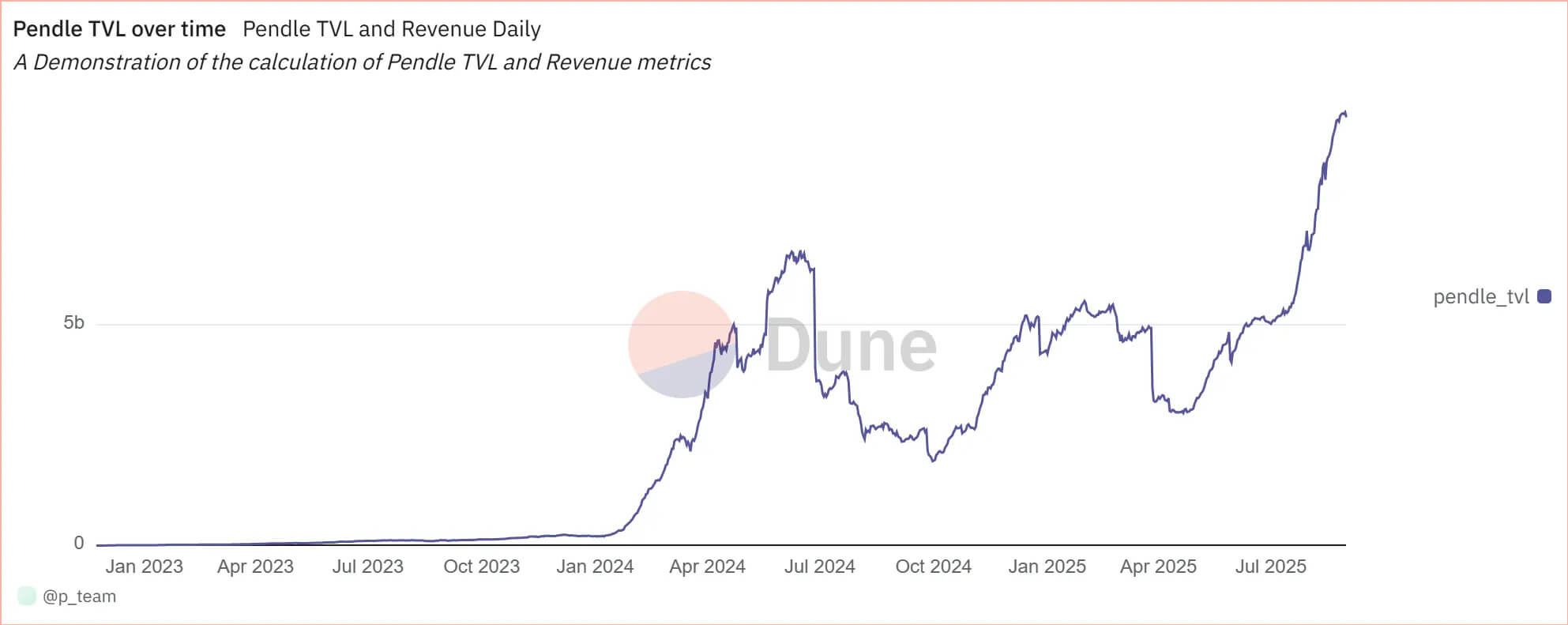

Fixed Rate

The category of fixed rate protocols is largely dominated by Pendle, which has grown to approximately 10b$ TVL. The demand for Pendle is closely related to the previously discussed yield opportunities, most notably Ethena and looping trades using Ethena Principal Tokens on Aave, which is responsible for roughly half of the TVL on Pendle. Pendle will likely remain the category winner, as it has established strong network effects surrounding liquidity and integrations.

Reflexivity

It is no coincidence that all-time-highs in major asset prices correlate with the all-time-highs in DeFi TVLs, volumes and activity. This is crypto reflexivity at play. When asset prices rise, appetite for leverage rises, this increases yield opportunities which attracts TVL in DeFi and stablecoins. Increased activity further inflates asset prices due to strong fundamentals, which creates further room for token incentives to drive additional growth. It is all a virtuous loop, which in the end drives further asset price appreciation, driving increased use of leverage.

This spiral explains much of crypto volatility, on the upside and the downside. At some point, this leverage will be flushed out and we shall see downward reflexivity. For now though, we are in a strong positive uptrend across all major metrics. Whilst we may not have had a proper alt-season yet, from a fundamental point of view, we truly are in a second DeFi summer, with strong regulatory and institutional tailwinds yet to unfold. In a sense, the promise of DeFi - slowly absorbing TradFi and replacing old systems and institutions with protocols and unicorns - is playing out in front of our eyes. The future of finance is onchain.

For more insights and analyses on the state of DeFi, risk management, and other topics, follow Rob on X.

.png)