.png)

Measuring “Time to Cash” in Maple Vaults

December 2025

15 mins

Onchain vaults are a successful example of new financial instruments that are native to DeFi yet immediately familiar to both institutional and retail audiences. This is, in part, because many of the details in their strategies and operations get abstracted away for the purposes of user experience — and rightfully so. Users find themselves interacting with an onchain analog to traditional asset management firms as a result.

However, a look “under the hood” helps us understand the properties of onchain vaults more clearly to find new yield sources and avenues for growth. This is especially useful in the context of public, modular, and composable environments like DeFi where one instrument’s properties can play a role in others further up the stack.

An especially relevant property is duration, or what users experience as “time to cash.” This report looks at how “time to cash” actually behaves in three Maple vaults, using onchain withdrawal behavior as the lens:

- syrupUSDC

- MPLhysUSDC

- syrupUSDT

Across all three, the focus is Effective Redemption Duration (ERD) as the key metric. We can use ERD as the technical term for the time between a withdrawal request and the redemption of shares, including partial fills where those exist.

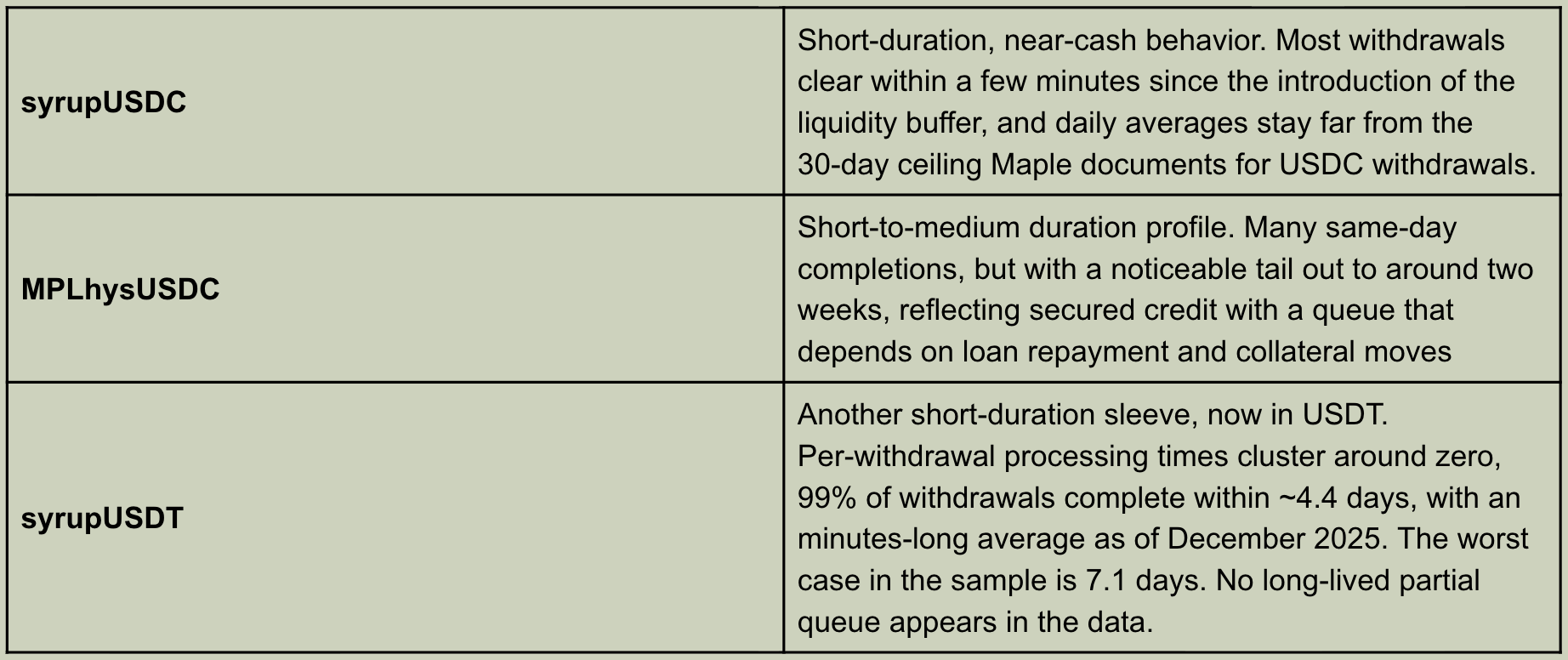

Here, we get the following high‑level picture:

- syrupUSDC behaves like a short‑duration, near‑cash position. Most withdrawals clear the same day, taking less than 5 minutes on average for the past two months thanks to near-instant liquidity. Days with multi‑day averages are rare and remain well inside the “up to 30 days” withdrawal window Maple communicates for syrup.

- MPLhysUSDC sits in a short‑to‑medium duration band. Many withdrawals are still same‑day, but there is a visible tail out toward roughly two weeks, which fits a secured‑credit vault where liquidity ultimately depends on loan repayments and collateral management.

- syrupUSDT also shows a near‑cash profile: median Effective Redemption Duration is 0 days, the average per‑withdrawal processing time is about 0.28 days. Over the past two months the average has been less than 5 minutes as well. Even the slowest withdrawal in the sample completes in 7.1 days, again comfortably inside Maple’s stated “up to 30 days” range for syrupUSDC and syrupUSDT.

The aim is to put concrete numbers on “time to cash” across these vaults, using what actually happens onchain beyond stated withdrawal windows. This paints a clearer picture for Maple users and allows other DeFi developers to interact more productively with its onchain vaults.

Methodology

For each vault, Effective Redemption Duration (ERD) is calculated in the following manner:

ERD = timestamp of share redemption - timestamp of the corresponding withdrawal request.

For each day in the sample, an average ERD (withdrawal‑weighted) median ERD, and maximum ERD are computed. Aggregations also count how many days have an average ERD above simple thresholds (e.g., >1 day, >7 days).

Where full withdrawal lifecycle data is available, processing times are also summarized at the individual withdrawal level (mean, median, percentiles, and maximum, plus status breakdown).

The full results of this onchain analysis can be found in this dashboard created in collaboration with Serotonin.

Why Maple Vaults?

Maple Finance is one of the clearest examples of an onchain vault system that behaves like institutional credit infrastructure that is familiar to the incoming wave of TradFi adopters. From its earliest design, Maple focused on underwriting real credit risk onchain where loans are originated to institutional borrowers. That makes Maple an especially strong case study for analyzing “time to cash,” because duration is a deliberate design variable tied to how credit is originated, secured, and repaid.

Maple has also been explicit about liquidity expectations and withdrawal mechanics. This transparency makes it possible to test stated withdrawal windows against actual onchain behavior.

Finally, Maple sits at a strategic intersection for the next phase of onchain finance. As vaults expand from crypto-native lending into RWAs, receivables, and other longer-duration assets, understanding and managing redemption timing becomes critical. Maple’s vault architecture already spans a meaningful duration spectrum, making it a natural foundation for deeper analysis and for composable risk tooling upstream.

Studying Maple vaults through an ERD lens not only clarifies how “time to cash” works today, but also provides a practical reference point for how future credit-heavy onchain vaults can scale responsibly with explicit, measurable duration risk.

syrupUSDC – Short Duration, Near‑Cash Behavior

syrupUSDC is an open, non‑US pool, sourcing yield from overcollateralized institutional loans originated via Maple. Withdrawals are handled through requests that go into a FIFO queue where interest continues to accrue during wait time. When liquidity is available, withdrawals are processed automatically and sent to the lender’s wallet

Maple’s documentation for syrupUSDC and syrupUSDT states that most withdrawals are processed in under 24 hours, but in low‑liquidity periods processing can take up to 30 days.

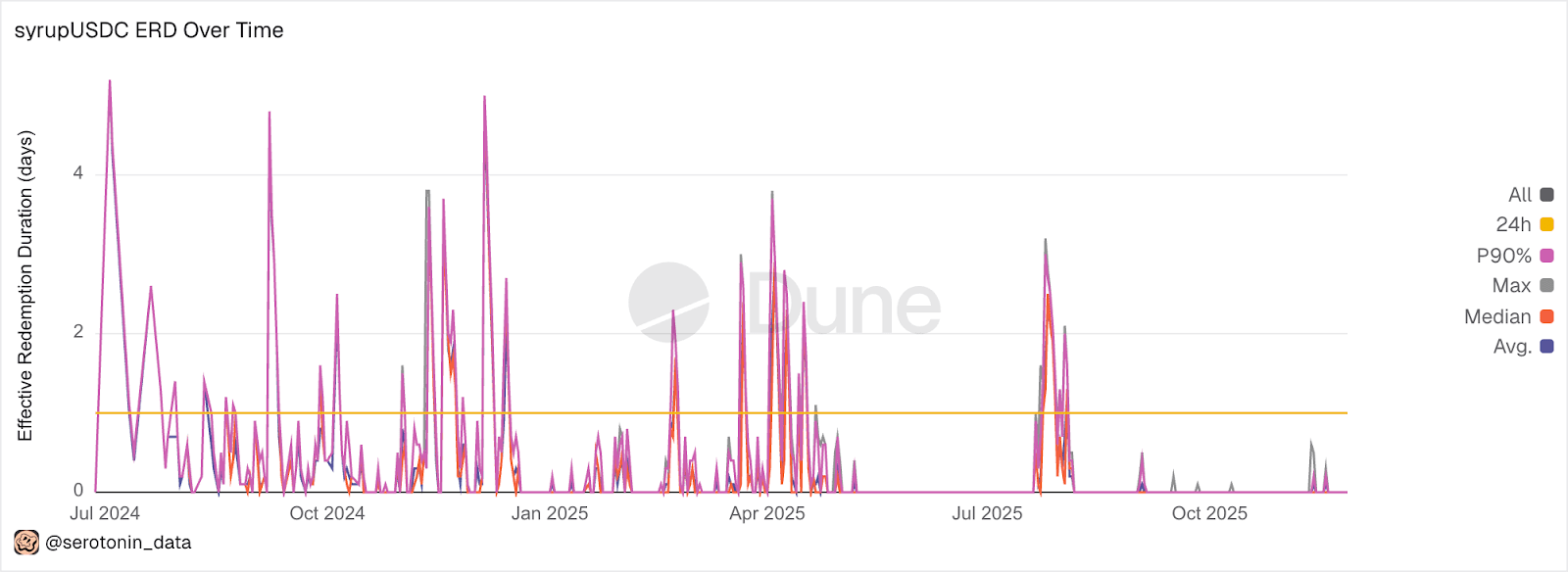

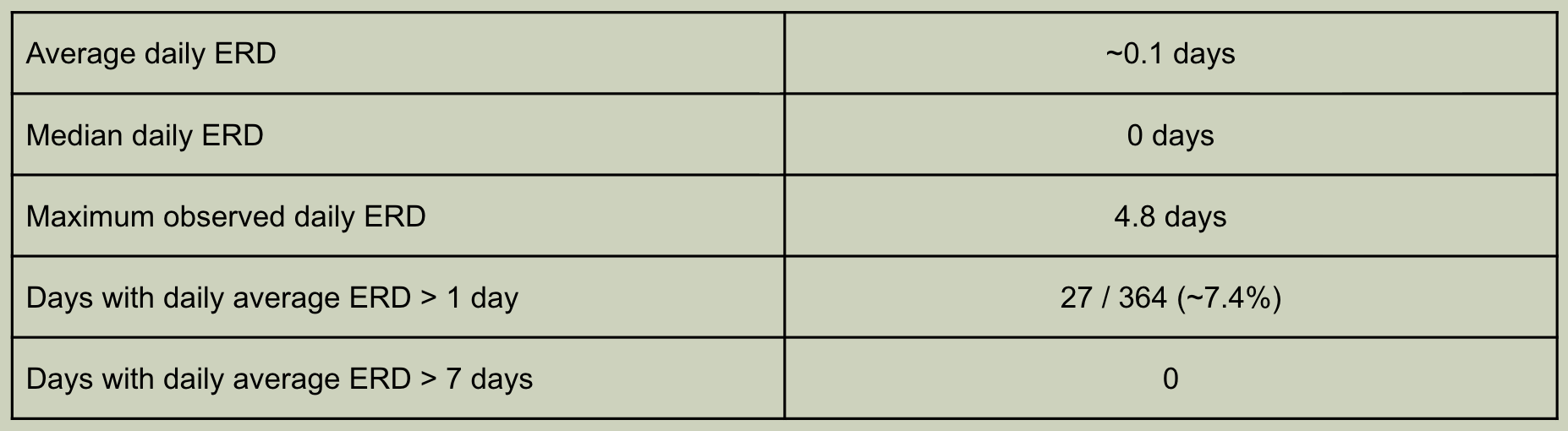

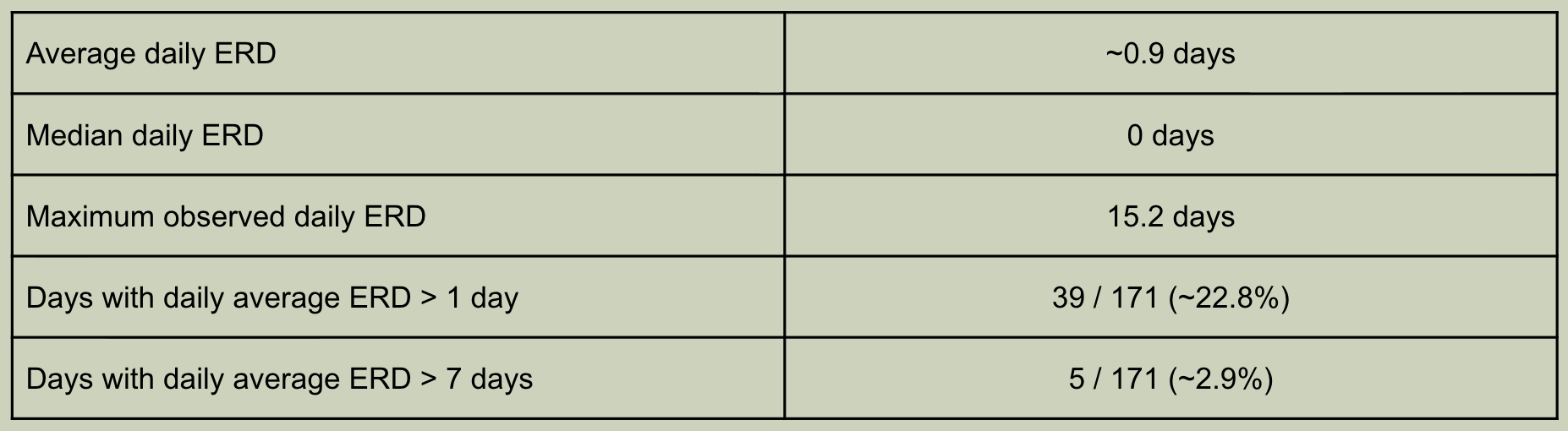

A look at Effective Redemption Duration (ERD) between 21 November 2024 and 20 November 2025 shows:

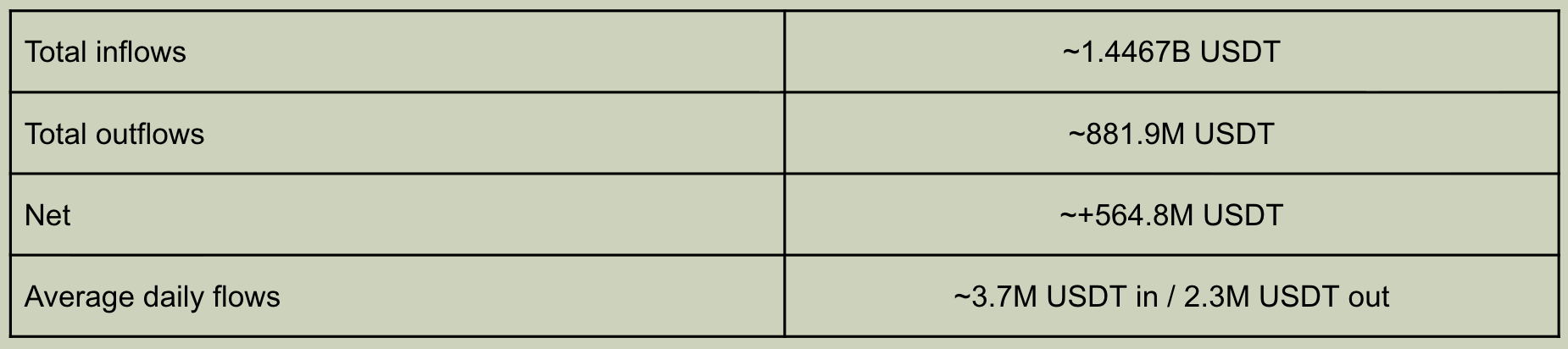

Over the same window we see flow behave as follows:

Interpretation

syrupUSDC behaves like a near‑cash yield asset. Most days show same‑day withdrawal behavior, a minority show modest multi‑day averages, and nothing in the sample pushes near the 30‑day upper bound Maple communicates.

MPLhysUSDC – Higher Yield With a Visible Duration Tail

MPLhysUSDC is Maple’s high‑yield secured lending vault. Different from syrupUSDC, it has permissioned access with KYC / AML with typical minimum deposits of $100k USDC. The vault sources yield from overcollateralized institutional credit managed by Maple. Withdrawals handled via a queue mechanism similar to syrup, however, processing time is ultimately constrained by liquidity from loan repayments and collateral moves.

Maple’s broader syrupUSDC/T/secured lending materials describe typical withdrawal times of under 24–48 hours, with stressed scenarios extending toward 30 days, reflecting the duration of the underlying loan book.

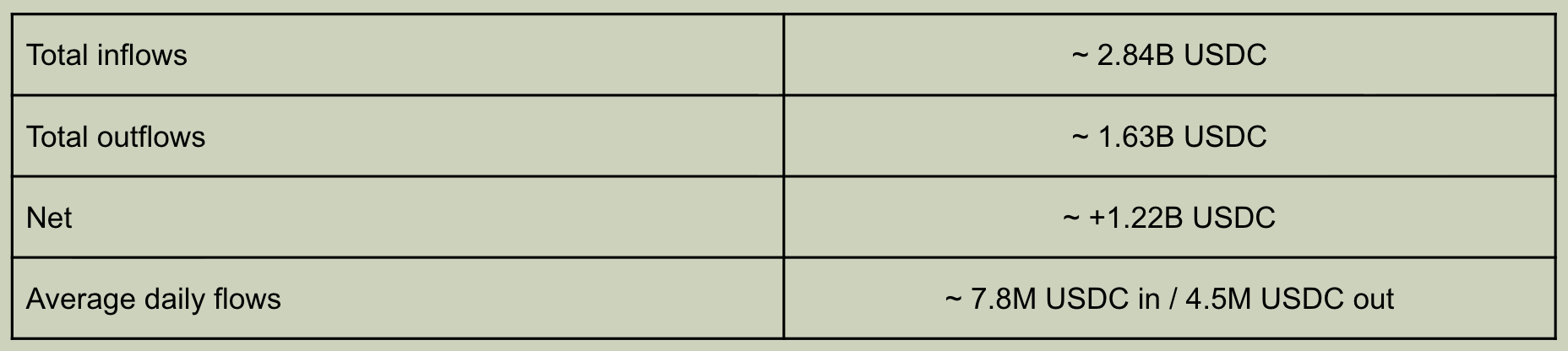

A look at Effective Redemption Duration (ERD) over the same one‑year window as syrupUSDC, 21 November 2024 to 20 November 2025, shows:

Flows show:

Interpretation

MPLhysUSDC still has a large share of same‑day withdrawals, but a noticeable portion of days show multi‑day Effective Redemption Duration, stretching out to around two weeks. That is exactly what you’d expect from a secured credit vault using a queue: liquidity depends on repayment schedules and collateral management, so redemption times move more than in syrupUSDC and syrupUSDT but remain contained.

syrupUSDT – Near‑Cash Behavior in USDT

syrupUSDT operates as an Ethereum pool with bridged variants such as Plasma that sources yield from overcollateralized institutional loan book just like syrupUSDC. It can be understood as the USDT version of syrupUSDC where lenders deposit USDT, receive a syrupUSDTtoken that appreciates via an increasing exchange rate, and can either:

- Request a withdrawal via FIFO queue, or

- Exit via secondary liquidity (e.g., AMMs) when available, if they prefer instant swapping over near-instant queueing.

Withdrawal docs apply to both syrupUSDC and syrupUSDT and state that most withdrawals are processed in under 24 hours, but In low liquidity conditions processing can take up to 30 days.

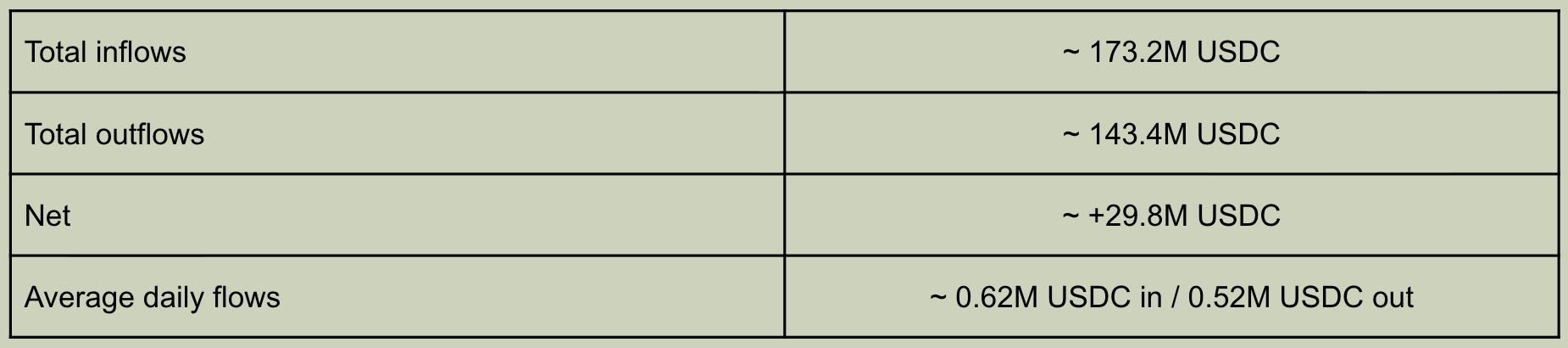

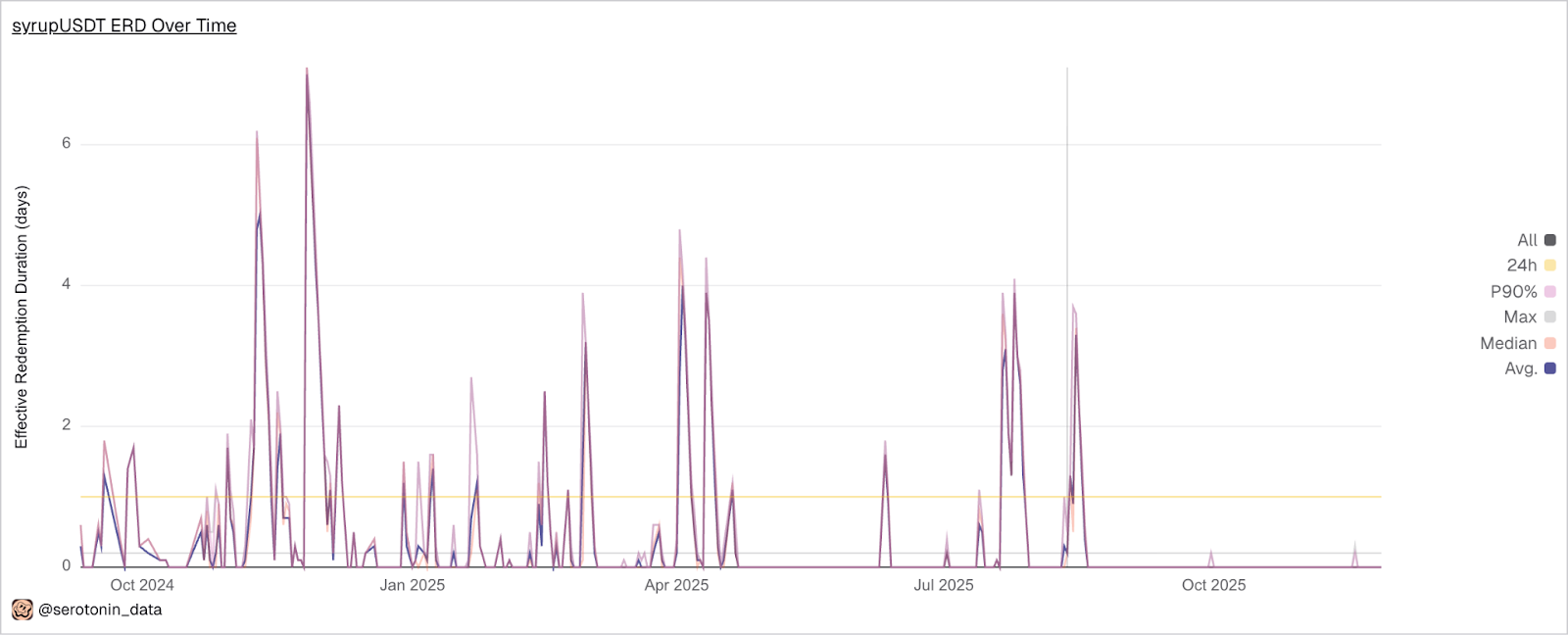

For syrupUSDT, we take a look at a Effective Redemption Duration (ERD) dataset that covers 10 September 2024 to 27 November 2025 with 388 calendar days of data. Over that period, we see:

Over the same period, we see the following flows:

Interpretation

syrupUSDT is behaving like a short‑duration yield sleeve in USDT where per‑withdrawal processing times are tightly clustered around zero. A large majority of days show 0‑day or sub‑day average Effective Redemption Duration, with a limited set of days where the average creeps into the multi‑day range, and none where the daily average exceeds 7 days. 99% of processed withdrawals complete within roughly 4.4 days and the slowest case in the dataset is 7.1 days, well inside the “up to 30 days” boundary Maple sets out for syrupUSDC and syrupUSDT. There is no evidence of a persistent partial withdrawal queue; the system is effectively “one‑shot” processing for the period observed.

How the Three Vaults Line Up on Duration

In summary, putting all three vaults on the same Effective Redemption Duration (ERD) axis shows:

Viewed together, these three give a data‑backed duration spectrum anchored in what actually happens onchain:

- syrupUSDC and syrupUSDT are effectively near‑cash, yield‑bearing positions.

- MPLhysUSDC introduces a higher‑yield, slightly longer duration component that is still manageable and consistent with Maple’s disclosed withdrawal windows and secured lending design.

Why This View Is Useful

The Effective Redemption Duration (ERD) lens is meant to complement Maple’s own disclosures, not replace them. It shows that actual onchain withdrawal behavior is consistent with the way the products are described: short‑duration for syrupUSDC and syrupUSDT, and a modest but visible tail for secured credit like MPLhysUSDC.

More importantly, it gives allocators a quantitative way to talk about “time to cash,” rather than treating all yield‑bearing USDC/USDT exposures as if they behaved the same under redemptions. This makes it easier to reason about how these vaults might be combined with other, longer‑duration Maple products (for example, real‑world receivables pools) in more complex constructions.

In these fast-emerging use cases, tools like Cork can serve as a key enabler to help secure vault strategies from the duration risk that may exist in real-world asset (RWA) markets. For a vault like MPLhysUSDC, for example, it could open a door for looping strategies where liquidators have peace of mind around “time to cash” delays.

Cork provides composable primitives that measure, price, and shift duration risk away from vaults and lenders and onto Cork underwriters. This operationalizes mid-to-longer term duration, creating more liquid and broadly composable assets.

Ultimately, Cork helps vaults like Maple pre-emptively solve for “time to cash” as they safely expand into new budding markets like RWAs. It also helps other DeFi instruments work with Maple more effectively.

Learn more about Maple at maple.finance and participate in its onchain vaults. If you’re curious about how Cork’s risk tokenization primitives can help your protocol expand to new markets visit corkprotocol.org, follow on X, or reach out to the team.

.png)