.avif)

Who Made Money off the FDUSD Depeg?

April 2025

5 mins read

The FDUSD depeg on April 2 is not the first or the last of these events. Neither was it the most consequential. The depeg lasted a total of 36 hours and FDUSD is back to trading 1:1 at the time of this writing.

However, the event does shine a light on what happens during depegs and how market actors respond. It also points to certain onchain actions that might help us predict future depegs.

Let’s look at what the timeline tells us with data analysis from serotonin.co

Timeline

We should look at the FDUSD depeg in context. Approximately 98% of all circulating FDUSD was centralized in a few large wallets, primarily held by major institutions like Binance omnibus wallets and market-makers. Such centralization increased market vulnerability, with large withdrawals potentially destabilizing the token’s price.

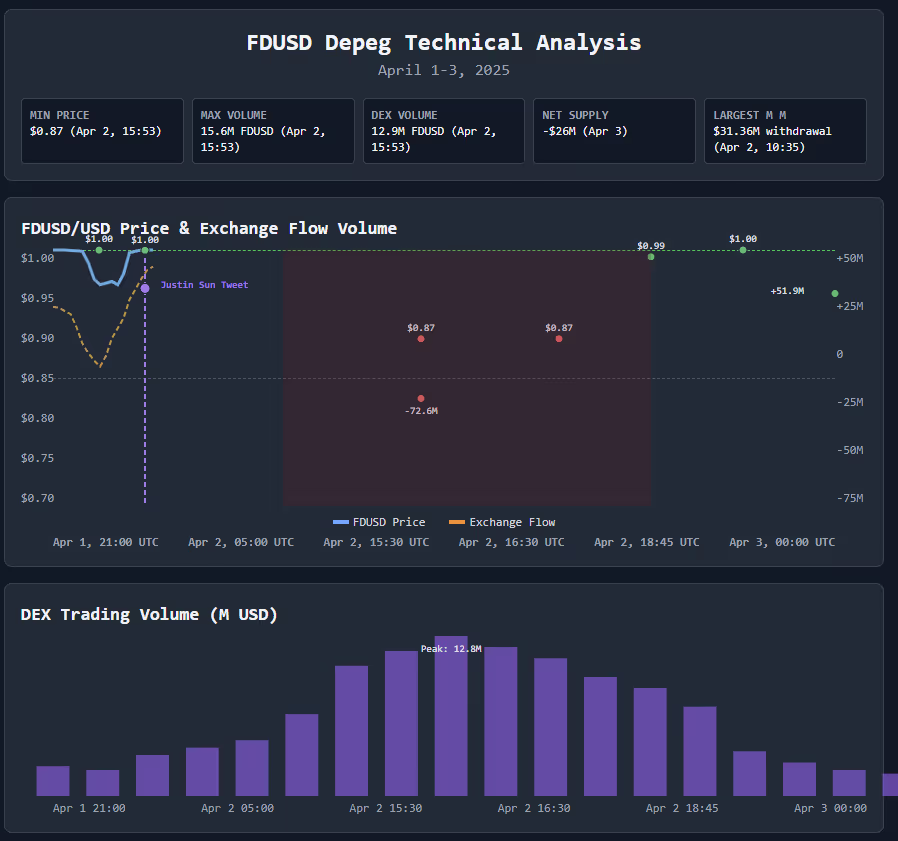

With this in mind, we can look at the timeline for the depeg event from April 1 to April 3, as well as key market signals that appeared in the weeks before that could have signaled upcoming volatility.

April 1: Pre-depeg Phase

The timeline starts with observable market behaviors before the depeg. These can be interpreted as precursor signals.

There was a noticeable increase in FDUSD redemptions as early as March 31, which extended until April 2 when approximately $13M were burned shortly before insolvency rumors publicly emerged. On April 1, we see large wallet withdrawals for a total of around $30M from Venus Protocol. These activities indicate reduced confidence or proactive risk avoidance, not profit-taking at this stage.

April 2: Acute Depeg Phase

The morning before the depeg we see additional $8.8M withdrawals from Venus and $4M FDUSD borrowing activity with potential profit motive. Then, at 12:21 AM ET, Justin Sun tweets about FDUSD’s public insolvency rumors. This sparks large-scale redemptions of around $13M at $1.00 that reflect institutions exiting positions, returning capital, not profiting directly.

FDUSD’s price falls sharply to a low point of $0.87 over the course of the day. The market is affected by severe liquidity imbalances verified in Curve and PancakeSwap pools that have around 90–98% FDUSD pool concentration.

April 3: Recovery and Stabilization

In the midst of the depeg, large FDUSD holders rush in to absorb the risk. This has a positive effect on the market as the price of FDUSD rebounds to $0.90 driven mostly by arbitrage activity.

One market participant buys approximately 75M FDUSD at around $0.90 from Binance and PancakeSwap, profiting between $3-5M as FDUSD restored peg. Another purchases roughly 40–50M FDUSD at around $0.97–$0.98 from Binance, netting between $0.5-1.2M in profit.

The market does recover and FDUSD fully repegs to $1.00 the next day. Further redemptions significantly contract the FDUSD supply with $200M total burned representing principal withdrawal.

Reactions

In any depeg situation there are different actions market participants take regardless of whether the asset eventually repegs or not. These actions are expressions of their risks, opportunities, and the resources that are available to them in these scenarios.

Depegs are particularly worrisome to DeFi users who might be leveraged-in and usually have a less immediate and latency-ridden course of action to take in order to protect their funds. Liquidity providers who were late to withdraw from FDUSD-affected pools would’ve realized losses of around 10–13% in their positions due to impermanent loss. One particular borrower incurred significant defensive costs after adding 1,500 BNB in collateral to their position in order to avoid liquidation.

Likewise, approximately 22,005 retail wallets, holding between 10-250,000 FDUSD each, can be identified as holding roughly 9.31M FDUSD, collectively, before the depeg event. A number of these retail wallets offloaded around 3.08M FDUSD, many of which panic-sold to larger FDUSD holders at a low price point. Their collective losses amounted to ~$56,000.

- On-chain DEX sales show around 2.4M FDUSD sold at an average price of $0.983 on for an estimate of $32,000 in total losses.

- Off-chain, untracked sales show around 0.68M FDUSD sold at average price of $0.9642 for an estimate of $24K in total losses.

Retail losses were minimal. However, while not nearly as consequential as many other depeg situations have been for DeFi users and retail investors, these holders could have avoided any losses altogether if risk management and hedging strategies were available to them.

On the other hand, large FDUSD holders with over 250,000 FDUSD benefited from the depeg’s arbitrage opportunities as seen in the timeline of events. The total of collective profits for these holders can be estimated to be around $3.5–6.2M.

- 0xdbf5e9c5206d0db70a90108bf936da60221dc080 profited between $3–5M from discounted FDUSD purchases.

- 0x9a21cf1552630a00eed185f3aaf7af3751226e42 profited between $0.5–1.2M from FDUSD arbitrage.

- Venus FDUSD Short Borrowers explicitly documented profits between 40–80,000.

- Early LP Withdrawers explicitly avoided impermanent losses of around 10–13%.

Additionally, there was significant activity from unnamed large wallets whose exact profits are not explicitly known, but engaged in sizable market moves of around $27M in total.

The Bottom Line

Large holders, presumably market makers and whales, were able to absorb the depeg risk and redirect the market for FDUSD from its $0.87 low point back to a $1.00 peg. There is also reason to believe that there was knowledge of a possible depeg shared beforehand due to observed behaviors in the days prior to the depeg.

These holders were able to benefit from the depeg via arbitrage and later redeemed FDUSD with the issuer at a 1:1 rate. Access to issuers is often enterprise-gated, however.

Stablecoin issuers are more likely to guarantee 1:1 redemptions to large holders who are KYC’d and have private access This kind of access is not typically offered to retail investors who instead panic–sell to these market makers and whales, losing value and arbitrage opportunities.

While retail losses were minimal, these users needed access to hedging strategies and opportunities similar to the arbitrage that larger holders are able to execute. Their course of action might have been different if they had a mechanism to redeem stablecoins 1:1, just as these more connected holders do. Likewise, the stablecoin market would be more efficient if there were pricing mechanisms for this type of risk.

Stay in the loop with Cork as we add new markets to protect all users from depeg events by following on X. Contact us if you want to open a market.

Examine the data by reviewing this Dune dashboard made in collaboration with Serotonin.

The data and analyses presented in this blog are sourced directly from onchain data reflecting DEX activity, Curve Pool dynamics, Venus Protocol transactions, and FDUSD transfers and supply changes between April 1–3, 2025. All interpretations and speculations regarding potential profit-taking or participant motivations are forensic inferences derived exclusively from onchain transaction data cross-referenced with asset prices and redemption values. These conclusions should be understood as analytical assessments rather than definitive statements regarding individual intentions or financial outcomes.

.png)