Is the Ethereum validator exit queue a ticking time-bomb in plain sight?

September 25

8 mins

Let’s investigate the mechanics driving the explosive growth in the validator exit queue and it’s consequences for DeFi.

Understanding the exit queue

To secure Ethereum, validators stake ETH. To ensure continuity of economic security, there is a limit to the amount of ETH that can simultaneously be staked and unstaked.

By design, only 1 in every 65k validators (of 32 Eth each) can exit each epoch. Each epoch lasts for about 6.4 minutes, which means there are 225 epochs per day. Assuming 8 validators can exit per epoch, this means 57,600 Eth can exit the network per day at a maximum.

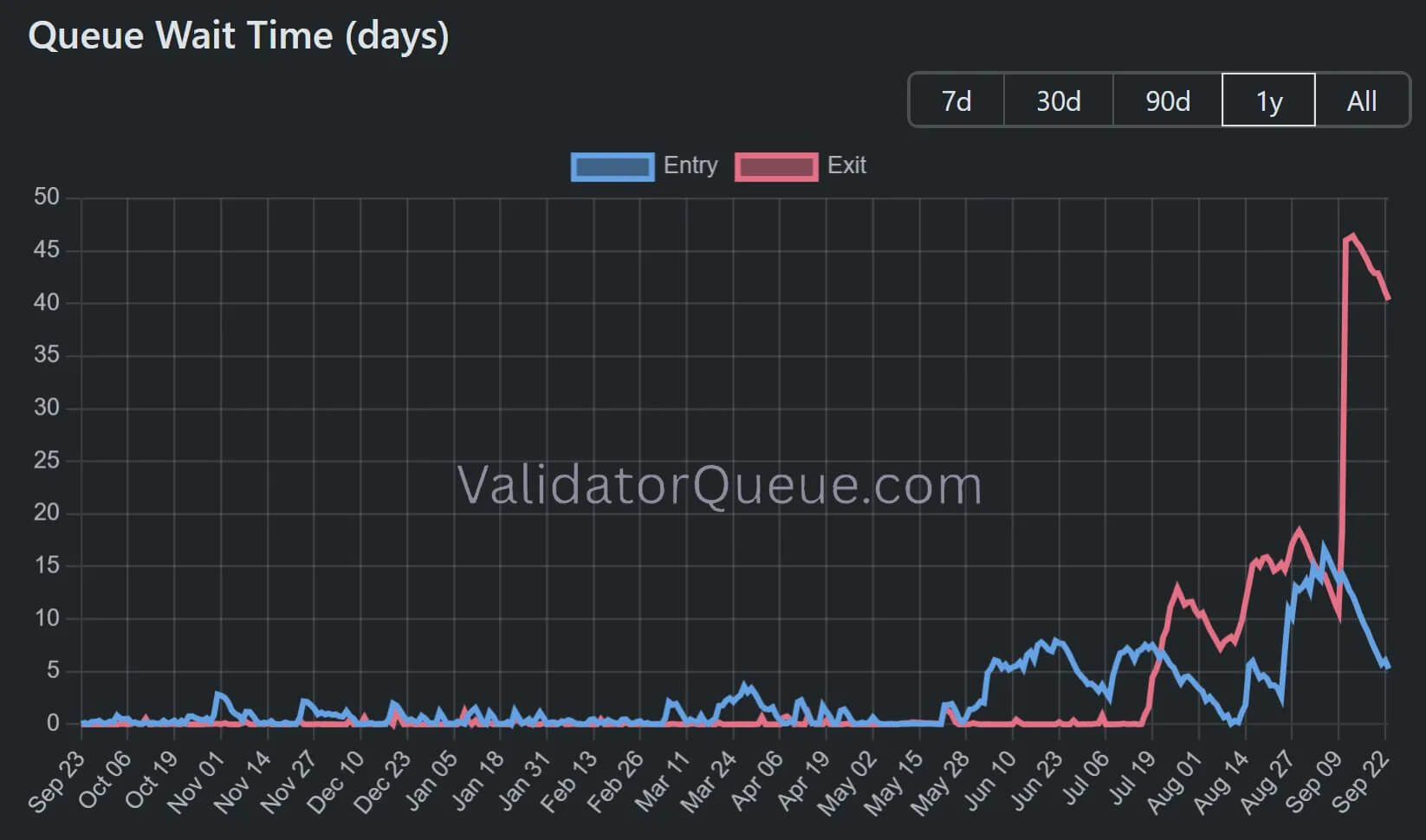

The validator exit queue has recently gone vertical, roughly tripling the previous all-time-high to reach 45 days. Fundamentally more people need to unwind their validators than there is exit capacity, resulting in growing queues. The problem is that this could trigger a vicious unwinding loop which has massive systemic impacts on DeFi, lending markets and the use of LSTs as collateral (to be explored below).

What drove the exit queue growth

The initial trigger to the queue was a reshuffling of ETH on Aave which drove a great stETH looping unwind (as explained here).

This created initial queue congestion. Since then, stETH has consistently been trading slightly below peg, reflecting a continuous unwinding of stETH through exit queue arbitrage (which we will explore further below). Subsequently, Kiln Finance for security reasons have rotated their validator set resulting in major volume across the entry and exit, this was the primary driver of the most recent spike.

There is significant FUD around the queue claiming that it represents sell-pressure overhang, that validators are dumping and as a result ETH price will tank. This is a fundamental misunderstanding of the dynamics at play. This unwinding is in my opinion largely neutral on ETH/USD because it relates to ETH rotations. Though, it has everything to do with the LST/ETH price, and the peg stability of major LSTs/LRTs. To understand this point, we must first understand the liquidity mechanisms of LST/LRT pegs.

LST peg stability

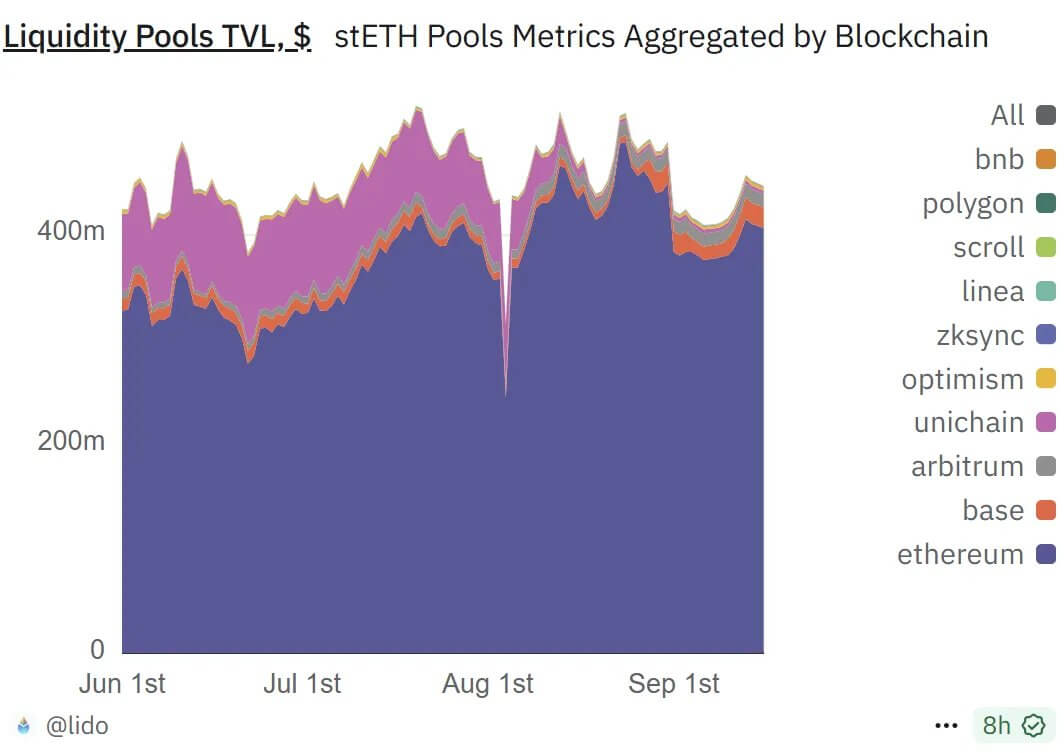

The by far largest LST is Lido stETH, with 86% market share. It has a TVL of $39b, however, it has only $450m in AMM liquidity.

A fraction of this liquidity can be exited at once without moving prices. As a result, only 10-20m$ can realistically exit through the AMM at any one time without creating meaningful price impact. The reason stETH is price stable, is because there is significantly more liquidity depth through secondary mechanisms that rely on peg arbitrage. Let’s dig into the arbitrage economics supporting LSTs like stETH.

Understanding peg arbitrage and secondary liquidity

If stETH trades at call it 0.99 ETH, you can effectively buy 1 ETH for 0.99 ETH, subject to the duration risk of waiting for the stETH to pass through the validator exit queue. Today, the queue is 45 days, which means if you would buy stETH, exit it and redo this trade, you are earning roughly an 8% APY. If the queue doubles again to 90 days, the APY will be 4%. There is a significant amount of capital on the sidelines looking to harvest this yield by purchasing depegged stETH to perform this arbitrage, assuming the implied yield is high enough.

If we assume the hurdle rate for arbitrage funds to lock their capital for 45 days is roughly 12% today, the true price floor of stETH is 0.985 ETH at current queue levels. Currently stETH is trading at a premium to this floor, however, I believe this is largely due to systematic inflows due to the space being in the latter stages of a major bull market. If inflows turn meaningfully negative, especially in the presence of a few major liquidations/unwindings, I believe we will start seeing stETH trading closer to it’s arbitrage related price floor. The larger the queue becomes, the more vulnerable stETH becomes to a depeg.

After ETH staking withdrawals were enabled, stETH has not meaningfully depegged, however, prior to this point it saw major peg instability with stETH depegging about 6.5% at it’s peak. Today’s environment is like a blend of pre-withdrawals (long duration risk) and the past two years where the duration risk was 1-5 days.

Each time a stETH sell order hits the market, this drives down the peg and triggers arbitrage through validator exits, which increase the queue size. The longer the queue becomes, the lower the implicit arbitrage yield whilst simultaneously increasing the position illiquidity for an arbitrageur, which increases the illiquidity premium that lowers the implied peg floor. This can become a vicious cycle.

How big can the queue get?

Based on the rate that validators can exit, if for example an additional 10% of validators exit (3.56m ETH), the queue grows by an additional 62 days to reach a 107 day delay. If 20% would exit, the queue approaches 169 days, almost half a year of duration risk, similar to the duration risk of holding stETH in late 2022 when withdrawals were 4-5 months away from being implemented and stETH traded consistently 100-200 bps below peg.

As we can see, the exit queue could meaningfully inflate in an unwinding scenario, which subsequently will have very meaningful impacts on the duration and liquidity profile of LSTs and LRTs. Now let’s dig into why this is so critical for DeFi and the potential contagion which may ensue.

Unwind triggers and vicious cycles in DeFi

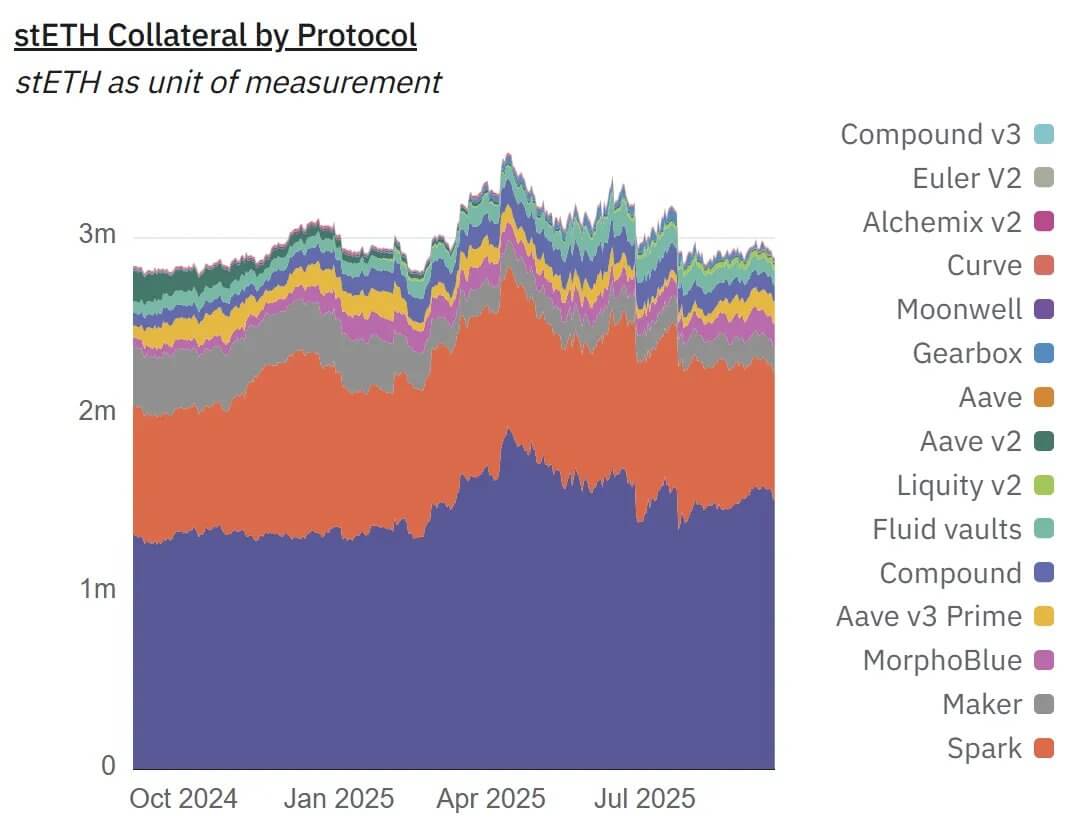

LSTs and LRTs are the largest collateral types in DeFi. Lido stETH alone is responsible for about $13b of TVL, largely across Aave V3 and Spark.

The use of LSTs in lending markets is largely driven by the looping/carry trade. Users deposit stETH or other yield bearing ETH LSTs/LRTs to borrow ETH. This ETH is used to buy more stETH which is used to again borrow ETH. Because the ETH borrow rate is generally lower than the stETH yield, each loop increases yield, as long as the borrow rate does not spike. On Aave the Loan To Value (LTV) ratio that loans can be taken out at is 93%, which enables a high degree of leverage. One can question if this LTV parameter shouldn’t be updated based on the withdrawal queue growth.

As a result, much of the ETH on Aave is lent out to this looping trade. If for example the market environment suddenly shifts, such that many ETH holders would like to rotate out of their positions (eg another Terra/Luna or FTX level event), there will be a significant withdrawal of ETH. However, only a limited amount of ETH can be withdrawn because the majority is lent out. This may cause a run on the bank, where ETH borrowers try to withdraw asap which spikes utilization rates and as a result raises the borrow rate for loopers. Even larger individual fund rotations (such as Justin Sun earlier this summer) can cause borrow rate spikes.

In this scenario, loopers will be deeply under-water for several reasons:

1. They have a levered exposure to the borrow rate, which if it increases, results in levered negative yield which will force an unwind

2. To unwind, they would need to sell their levered stETH on the market. If stETH for example trades at it’s current arbitrage floor of 0.985, this means at 10x leverage you absorb at least a 15% haircut on the initial principal.

3. Because of the high LTV on loops, if trades are not unwound and the negative yield is high, positions will eventually be liquidated. There is nowhere near enough liquidity to absorb major liquidations and loopers will face significant liquidation penalties.

The net effect of any unwind scenario will be a reduction in stETH supply, which puts further pressure on the exit queue and the stETH peg floor.

Impact on vaults

The above scenario of utilization spikes and exit queue growth has meaningful impacts across Vaults. A significant portion of vault yields come from ETH lending market supply and stETH looping related yields. The increased duration risk of stETH means it cannot be quickly exited without a haircut. This would meaningfully complicate the redemption and liquidity profiles of vaults if there were major systemic outflows.

Front-running risks

As we approach the latter parts of the bull market, many funds will start considering their exit path including rotating out of validators and LSTs. The growth of the exit queue fundamentally changes the liquidity profile of any exposure related to ETH staking, in this scenario, you could imagine funds starting to front-run further queue increases by exiting validators such that they have ETH available to sell when the time is right. Is it worth 3% yield to be illiquid for 45 days when prices move 20% per week? Not really. There is a real risk of a self-reinforcing loop where the exit queue as a result grows further in anticipation of further queue growth in a downtrend. I am personally rotating out of LSTs/validators for this reason.

Solutions

There is a clear and apparent lack of tooling to deal with duration risk in DeFi. This issue is not isolated to LSTs, for example duration risk has been a major blocker for longer duration RWAs to be integrated into DeFi to support looping trades. These use cases are specifically why we designed for and built Cork to provide a market based solution to price and manage duration risk. Cork enables the creation of “swaps” markets that provide an instant liquidity buffer and enable hedging of duration risk. Long term capital providers can absorb the duration risk as a service in exchange for yield, to support instant liquidity for looping markets, vaults and funds.

As an ecosystem, we need to be aware of and adequately manage duration risk. As a collateral type, LSTs and LRTs have varying degrees of duration risk depending on the queue type, and risk management frameworks need to factor these in their assessment of lending market and vault designs. If an asset goes from 1 day duration to 45 days duration, it is no longer the same asset. For example, oracles should have a discount factor based on duration (similar to how Pendle PTs are valued), as opposed to solely looking at the fundamental backing of stETH. I have written a longer piece on duration risk here for those curious.

Since LSTs are fundamentally a useful and systemic infrastructure to DeFi, we should consider making upgrades to the throughput of the exit queue. Even if we increased throughput by 100%, there would be ample stake to secure the network. DeFi is one of the biggest use cases of Ethereum and as recently argued by Vitalik - a major driver of economic security.

This minor tweak would boost the quality of the biggest collateral type in this ecosystem, which as a result may strengthen it’s economic security.

So far we have not seen any major depegs of LSTs/LRTs from the exit queue growth, but this doesn’t mean they are not highly susceptible to a depeg in current conditions. If the inflows and uptrend reverses, we are at risk of seeing real unwinding occur. It is only in such scenarios, that duration risk truly rears its ugly head, when liquidity dries up and everyone tries to exit. As an ecosystem we need to be ready to weather storms, because if one thing is for sure it is that another storm will come. It is only a question of wen.

Contact us to discuss further.

.png)