.png)

Cork Phoenix is Live on Ethereum Mainnet

January 2026

8 mins

Cork Phoenix is live, kickstarting a new phase in the evolution of risk management. As a programmable risk layer, Cork will enable the integration of tokenized risk for onchain assets such as RWAs, vault tokens, and yield-bearing stablecoins. This will open new markets for long-term duration assets via products such as Cork’s Protected Loops primitive.

The Growing Need for Risk Tokenization

Risk management has always been one of finance’s most important inventions. The ability to pool and distribute risk was foundational to the rise of modern economies, whether through maritime insurance, fire policies, or early life annuities.

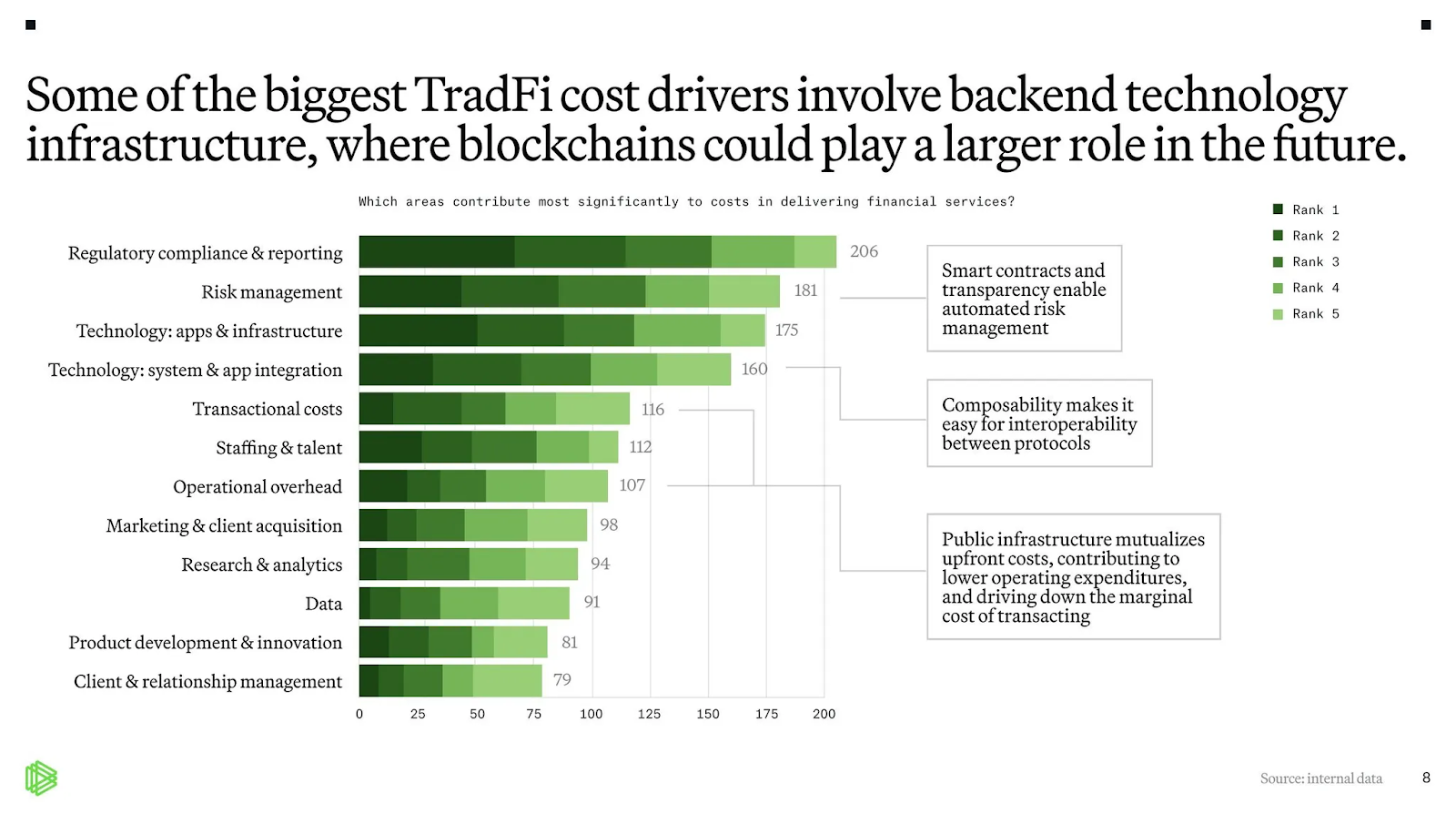

Today, our economies are digitizing at every layer. As onchain adoption accelerates and institutional capital enters the space, risk infrastructure is emerging as a foundational pillar for the next phase of crypto’s growth. There is clear commitment from banks and asset managers to leverage public blockchains to reduce costs and increase efficiency. Today, risk management is one of the top cost drivers for these institutions to deliver financial services to end customers (source: Paradigm).

Paradigm TradFi Tomorrow Report

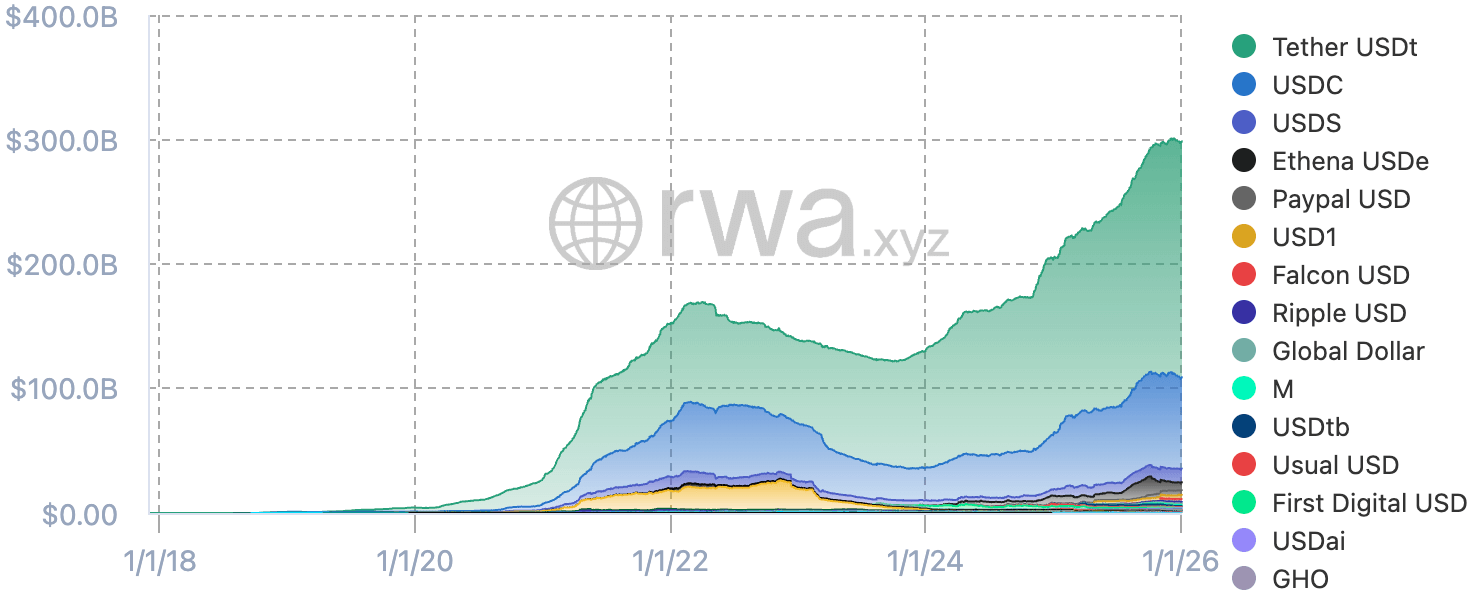

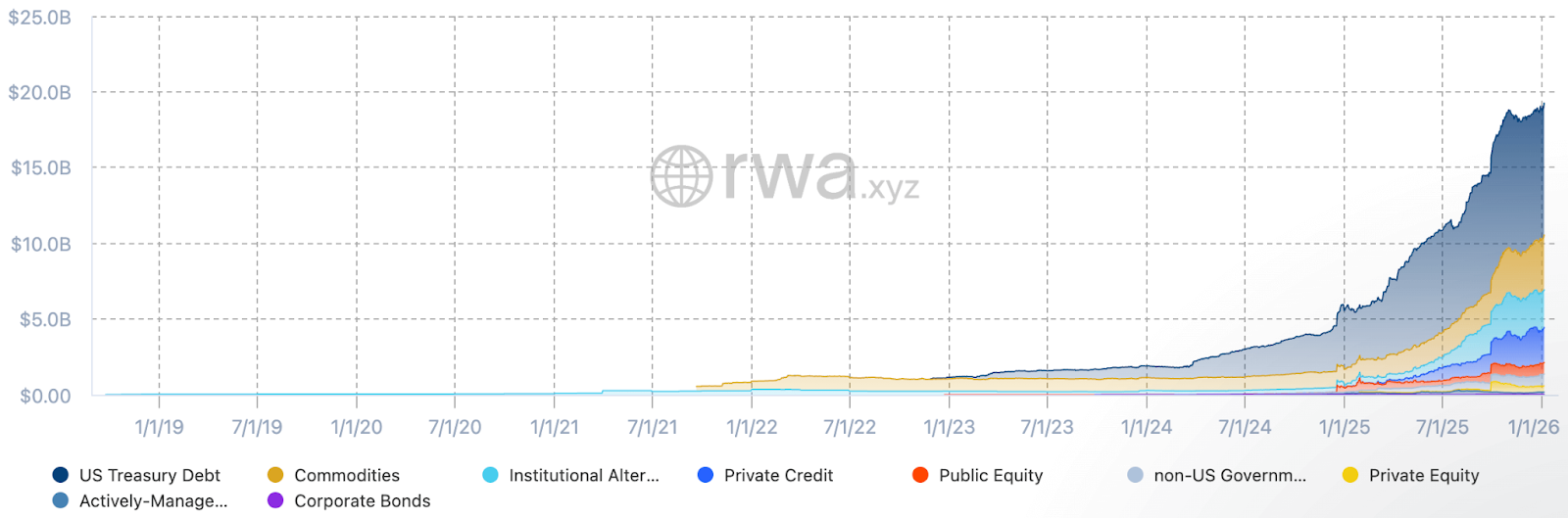

There is also growing institutional demand for risk-managed DeFi exposure, particularly around stablecoins and onchain yield products. This is evident as the stablecoin market has more than doubled since early 2024, from $130 billion to over $300 billion, while tokenized real-world assets have surged from $1 billion in 2021 to almost $20 billion today (source: RWA.xyz). In 2025, tokenization entered mainstream finance: Nasdaq approved trading of tokenized stocks and ETFs, and Robinhood launched tokenized U.S. equities for European clients, alongside a wave of similar institutional initiatives.

Total Stablecoin Value as of January 2026

Total RWA Value as of January 2026

Yet even as billions flow into DeFi, robust tools for identifying, pricing, and transferring risk remain underdeveloped.

Historically, the Terra–Luna failure vaporized over $40B and set off a credit contagion that blew up some of the largest institutions in crypto. The episode underscored how the hidden leverage and credit risk can adversely affect the entire ecosystem.

More recently, we have seen the largest liquidation event in history on crypto’s “Black Friday,” October 10, 2025, when multiple pegged assets traded below their peg on certain centralized venues. The effects propagated into other markets. USDX subsequently suffered a major depeg in November due to liquidity crunches from the Balancer exploit, the Black Friday crash, and cascading liquidations in leveraged vaults raising questions about potential undisclosed losses.

As long as DeFi users remain hungry for yield, this problem will not go away on its own. The oracle configuration problem, whether pegged assets should be hardcoded 1:1, reliant on PoR, or reliant on market prices, is just one aspect to the problem. Even a perfect oracle solution does not account for the duration component that is inherent to most yield-bearing pegged assets. If this duration risk is not acknowledged, it won’t be long before DeFi users are once again reminded that there is no such thing as a free lunch.

For institutional players to meaningfully participate in DeFi and for the tokenization of RWAs, credit, and stablecoins to scale, onchain finance needs institutional-grade risk primitives that are programmable, transparent, and composable.

The Future of Risk

Cork serves as that missing primitive. It is a risk infrastructure toolkit built for onchain finance.

With Cork, market participants can price, hedge, and trade a wide array of onchain risks, from default and duration risks to depegs.

By filling the current infrastructure gap, Cork helps make asset tokenization viable for a broader range of institutional users, turning risk from a barrier into a design space for innovation.

We’re building the programmable risk layer for public blockchains: a set of composable, transparent, and auditable primitives that let markets price, hedge, and trade asset‑specific risk on demand.

Our commitment is simple: make onchain risk explicit, and tradable. By standardizing how risk is represented and cleared on public chains, Cork unlocks resilient pegs, sturdier credit, and investable yield at institutional scale.

Risk Tokenization in Action

The benefits of tokenized risk are key to DeFi. Cork is focused on applying it to two key use cases: looping strategies and instant liquidity buffers.

Protected Loops is a new DeFi primitive introduced by Cork that enables safe, capital-efficient looping strategies for long-duration or illiquid assets, such as real-world assets (RWAs) and yield vault tokens, that traditionally couldn’t be looped safely. It combines a managed looping vault with an embedded liquidity hedge via Cork Pools, where underwriters provide liquidity that the vault can access instantly to unwind or liquidate positions if needed. Effectively, the primitive acts as an onchain emergency liquidity backstop.

Cork also teamed up with Agglayer to enhance cross-chain withdrawal experiences by pairing tokenized risk infrastructure with Agglayer’s Vault Bridge settlement layer. The result is a dedicated liquidity pool that ensures users on Katana and other Layer 2s can instantly redeem and withdraw assets even under high collateral utilization or market stress. At the same time, liquidity providers earn yield plus a risk premium for underwriting liquidity risks. This solution strengthens capital efficiency and confidence in onchain asset exits across volatile conditions.

We are actively working with partners on the next Protected Loops and On-Demand Liquidity pilots. If you are an asset issuer, risk curator, or building vaults, contact us to discuss upcoming markets and integrations.

.png)