.avif)

Cork: The Tokenized Risk Primitive Is Now Live

March 2025

5 mins read

TL;DR

Cork Protocol, a new DeFi primitive to price, hedge, and trade risk, is launching its public beta on Ethereum Mainnet with key launch partners: Lido, EtherFi, Ethena, and Sky. This introduces a significant new space of tokenized risk for crypto holders and the DeFi ecosystem, offering a novel approach to pricing and protecting against depeg events for stablecoins, liquid staking tokens, and restaking tokens.

Cork: Tokenized Risk

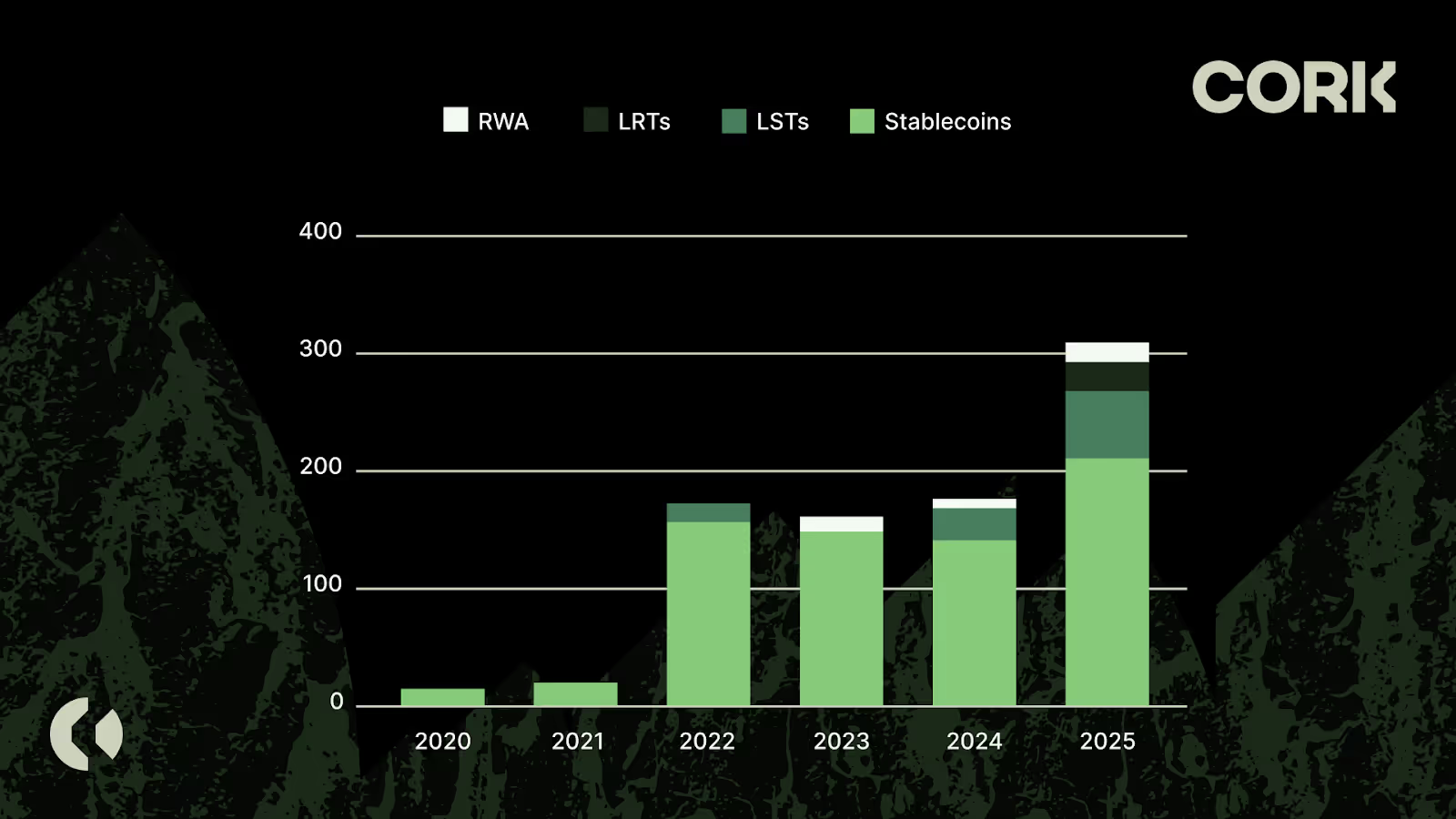

The world's credit markets are moving onchain. Today, there is over $300B of “onchain credit” in the form of stablecoins, LRTs, LSTs and RWA credit. This figure, however, is a drop in the bucket of the ~$300T offchain credit market. We believe that in the future, the entirety of the credit market will be onchain, which will be a transformational shift for the crypto ecosystem. This shift is already happening at an accelerated pace, with recent unlock in the form of regulatory clarity from the new administration in the US, we anticipate a rapid expansion of the onchain credit ecosystem.

However, for this future to play out, onchain markets need to offer better utility and tooling than the offchain alternative. Whilst blockchains today offer improved transparency, cost, accessibility and various administrative efficiencies, a major area of missing utility is adequate risk management tooling. The vast majority of capital in the world is conservative and requires risk-managed strategies to be deployed. For crypto to attract these investors, it needs to unlock the risk management primitive. We are excited to announce today that this primitive has been unlocked with the launch of Cork’s beta version. We anticipate our risk markets will be the missing link to bring onchain credit to the trillions. If you believe the future of credit is onchain, it goes without saying therefore the future of credit risk markets must also be onchain. This is the future we believe in and are building.

Starting with Pegged Assets

The ecosystem with the most immediate need for risk-management solutions is pegged assets such as stablecoins and liquid (re)staking tokens. This ecosystem has hundreds of billions of dollars at stake - but there is no way to price or hedge against the pervasive risk of depeg events.

Depeg events are a recurring feature of DeFi which have shaped its history. For example, the Terra Luna collapse of 2022 was responsible for triggering a cascade of liquidations and defaults that destroyed 100s of billions in value, including contributing to the collapse of 3 Arrows Capital, Genesis, BlockFi, Celsius, and FTX. In the past month alone, the DeFi ecosystem has experienced multiple depegs, including most notably USD0++ which depegged by 10%+. Before Cork, the market was unable to form a price around the risk of depeg events, let alone the ability to hedge against or trade the risk premium. To date, DeFi has been an ecosystem with risk that is inherent but not priced, with layers of unrealized opportunities and exposed market participants. Core to the Cork protocol is the Depeg Swap, a novel asset that prices the risk of a depeg event, empowering crypto traders and funds to manage and trade pegged-asset risk.

In the immediate term for the DeFi ecosystem, we believe Cork will help accelerate the growth of yield-bearing pegged assets, including stablecoins and liquid (re)staking tokens through new risk-managed yield strategies. Cork will both unlock new capital to access these yield sources and also augment existing DeFi primitives with risk management. For example, the looping trade can now be fully hedged, allowing for risk-free leveraged farming strategies. Furthermore, risk markets will enable a new form of trading activity tied to risk, which will enable risk skeptics to profit from exposing fraud, which can prevent the next Terra Luna from becoming systemically integrated.

Cork’s Public Beta

With all this context, we are excited to share that Cork’s Public Beta is now live on app.cork.tech. As a part of the initial launch, we are going live with 4 markets that we are excited to roll out together with our launch partners Lido, Etherfi, Ethena, and Spark.

.avif)

During the beta period, which we estimate to last for 3-6 months, there will be supply caps on the Liquidity Vault, which will limit the size of the markets. In the coming weeks, you will see the introduction of new markets, novel DeFi integrations, increased TVL caps on our liquidity vaults, and new features to enhance onchain risk management.

Whilst the product is in beta, we have taken security for the launch extremely seriously, including conducting 3 smart contract audits (Quantstamp, Cantina, Sherlock), formal verification (Runtime Verification) and front-end penetration testing with Sayfer. We are excited to share the product and markets with the public and invite further feedback and suggestions to help enhance the product, including what markets you would like us to launch and which features or functionalities we should build next.

How does Cork work?

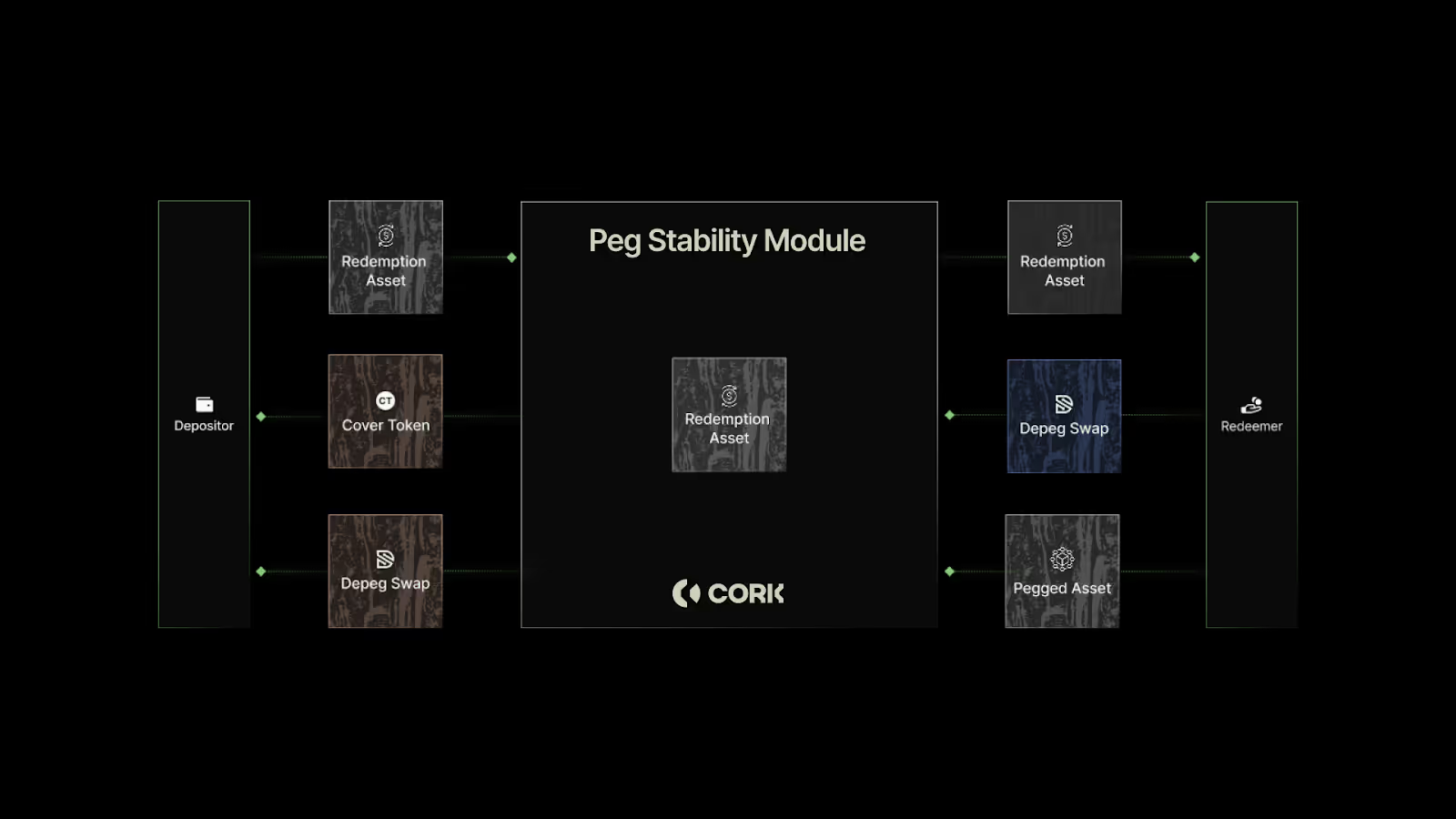

For a deep dive on our tokenomics review our not-so-lite litepaper. The core of the protocol is the Peg Stability Module, which is written on an asset pair:

Redemption Asset - the base asset used for redemptions (such as ETH)

Pegged Asset - tracks the Redemption Asset's price (such as stETH)

The Peg Stability Module has a Deposit Mechanism where the Redemption Asset is sent to a contract and split into Cover Tokens and Depeg Swaps representing the two sides of the trade. The Cover Token represents the underwriter of the risk and will receive all the assets in the Peg Stability Module at expiry. The Depeg Swap is a swap token that allows a user to exchange their Pegged Asset 1:1 for the Redemption Asset through the Redemption Mechanism. The Depeg Swap represents the pricing of the risk of a Pegged Asset and can be used to hedge, trade and be composably integrated in DeFi.

Liquidity Vault

To earn yield, Redemption Assets can be deposited into the Liquidity Vault, where they will be used to provide liquidity to an AMM, mint and sell Depeg Swaps as well as collect fees from the entire system. Effectively the underwriter of the risk receives a yield both from premiums as well as trading fees, which has the net effect of lowering the cost to receive coverage with the Depeg Swap.

How to Use Cork

There are several ways to leverage Cork in your portfolio depending on which side of the market you wish to take. A few options are to:

1. Hedge your exposures

If you have pegged asset exposures in your portfolio, you can buy our Depeg Swaps to hedge the depeg risk.

2. Trade risk

You can buy Depeg Swaps to gain highly leveraged (100x+) exposure on a potential depeg event. Risk traders help establish market pricing but utilizing our novel market to trade depeg risk.

3. Provide liquidity

Deposit into Cork's Liquidity Vaults to earn rewards from trading fees, risk premiums, and protocol fees by effectively underwriting the risk in the system. Our vaults offer high intrinsic rewards and capital efficiency, if you believe a certain asset pair is not going to depeg you can earn through the vaults.

How to Get Involved and Learn More

The best way to get involved is to join our Discord and follow us on X. If you wish to partner with us contact us using this form.

To learn more about Cork please see the following resources:

- Documentation

- Litepaper

- Explainer videos (soon)

- Tutorials (soon)

.png)